by Brad M. Weafer, CFA | Chief Investment Officer

Click Video Below for Quarterly Update

Key points

- Stocks staged a comeback in the fourth quarter, but still posted material declines for the year. Bonds also managed positive returns in the fourth quarter, but 2022 was one of the worst years on record for the bond market. Diversification outside of traditional stocks and bonds provided the only respite in a very challenging year.

- Despite more encouraging recent results, a myriad of economic signs suggests the economy is set to slow in the near future and corporate profits are likely to come under pressure in 2023. We have positioned portfolios more cautiously as a result.

- Easing inflationary pressures, a resilient U.S. labor market, a better-than-feared environment in Europe, and a reopening Chinese economy give us some reason to be optimistic, though this is balanced against widely negative sentiment.

- With uncertainty evident in the outlook, diversification across asset classes looks set to be an important tool for investors.

Fourth Quarter Recap

Capital markets (both stocks and bonds) posted their first positive results of the year in the final quarter of 2022. Equity markets rallied through October and November before finishing with a weak December. A change of leadership was notable during the quarter with international markets, European equities in particular, outperforming U.S. stocks. This change was consistent with signs from the currency market as the dollar weakened in the quarter. Interest rates steadied in Q4 helping fixed income produce positive returns with corporate credits performing better relative to lower-risk government securities.

A pyrrhic victory of sorts, the solid performance of Q4 was not able to wipe out what was a dismal year for investment returns. Global stocks returned -18% for the full calendar year, while the Bloomberg U.S. Aggregate Bond Index was equally, if not more, disappointing, returning -13%. The standard balanced portfolio consisting of 60% stocks/40% bonds produced results rivaling some of the worst years experienced in the last 50 years. Diversification away from traditional assets was important but challenging. Selecting asset classes such as commodities, private credit, and certain hedge fund strategies produced positive returns in 2022 and helped offset the tough results in stocks and bonds. Still other asset classes, most notably public real estate, experienced large declines.

Performance for select asset classes as of 12/31/2022

Data Source: Bloomberg. Global equities are represented by the MSCI ACWI Index, U.S. Large Cap is represented by the S&P 500 TR Index, U.S. Small Cap is represented by the Russell 2000 TR Index, International Developed is represented by the MSCI EAFE TR Index, International Emerging is represented by the MSCI EM TR Index, U.S. Agg Bond is represented by the Bloomberg U.S. Aggregate Bond TR Index, U.S. Corp Bond is represented by the Bloomberg U.S. Corporate TR Index, Global 60/40 is represented by 60% MSCI ACWI and 40% Bloomberg U.S. Treasury Index, Commodities is represented by the Bloomberg Commodity TR Index, and Real Estate is represented by the Dow Jones U.S. Real Estate TR Index.

Outlook

Inflation was a thorn in the side of markets all year. Fortunately, those trends appear to be headed in a positive direction, supporting recent investment results. After peaking during the summer, most major inputs to price increases have moderated, relieving pressure for both consumers and policymakers (see inflation history below).

Year-over-year change in inflation measures (Consumer Price Index)

Source: U.S. Bureau of Labor Statistics. U.S. CPI Urban Consumers (YoY, NSA)

Lower inflation is a welcome development, but the economic outlook remains murky following the significant interest rate increases enacted by the Federal Reserve over the past nine months. A variety of signs point to slower economic growth or outright declines, namely the inverted yield curve, declining housing starts, contracting manufacturing activity, and slowing retail spending. We are certainly not alone in that concern. A recent poll conducted by Bloomberg showed that two-thirds of economists surveyed expect a recession in 2023 (see below). Corporate profits historically decline in economic contractions and stocks follow suit. This leads us to a cautious outlook for markets going into 2023.

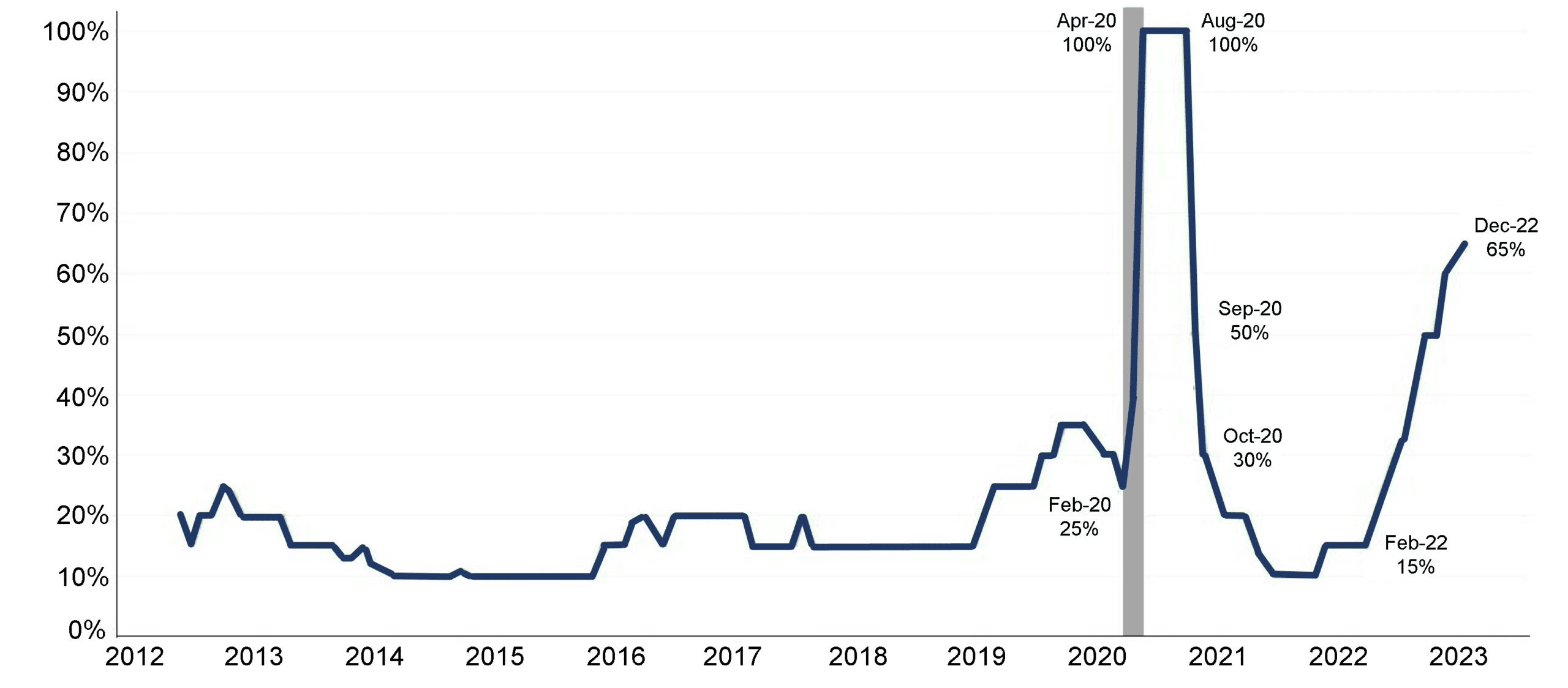

Economists’ Odds of a U.S. Recession Over the Following Year

Data Source: Bloomberg. Percentage of Bloomberg survey respondents who expect recession in the next year

Despite that caution, we see reasons not to get overly pessimistic. There have been questions all year about a slowing economy, but there are few signs any of those issues are materially affecting the labor market today. The unemployment rate remains near multi-decade lows and leading indicators of job weakness (like initial unemployment claims) show no signs of that changing imminently. Measures of income growth, including average hourly earnings and personal income, suggest consumers are making almost 5% more year-over-year, supporting continued economic growth. Those same consumers are also getting relief elsewhere, as gasoline prices have fallen over 30% from the peak. Absent an economic shock, a U.S. recession at minimum looks delayed to start the year. Globally, Chinese leaders are abandoning restrictive Covid lockdown policies. An expected release in pent-up demand in a very large market like China is likely to create a shot in the arm for the global economy. Other overhangs on global growth also appear to be waning, with resource prices moderating and the economic impact of sanctions on Russia annualizing. Aside from the fundamental backdrop, widespread economic pessimism is providing opportunities for better prices in both stocks and bonds. Valuations across markets start 2023 at much more attractive levels than they did at the advent of 2022. The most obvious change is in cash and fixed income instruments, where starting yields are above 4% in short-term Treasuries and over 5% in short-to-intermediate investment-grade corporate bonds. And should the economy prove more resilient than feared, stocks may surprise to the upside. This looks even more true of attractive relative valuations in small and mid-cap stocks, as well as international equities.

Portfolio Positioning

With an uncertain economic outlook, careful security selection and prudent asset allocation will be important tools, and we have been actively tilting portfolios in this regard. Consensus analysts continue to expect earnings growth of over 5% for S&P 500 companies, a figure which is at odds with the above-mentioned broad acceptance of a recession this year. While there are reasons to avoid being too pessimistic, we have added to our allocations of lower-risk asset classes like government and investment-grade bonds. Within equity allocations, our stock selections are also keeping earnings risk top of mind. Recent buys have favored companies and funds with higher levels of earnings resiliency as we expect these investments will have more defensive results in the face of economic weakness. Characteristics include companies with stable demand for their products, flexible cost structures favoring less fixed costs, and low financial leverage. While this has always been a hallmark of our long-term approach, it takes on even greater relevance today. We are also taking advantage of attractive relative valuations in small and mid-sized companies and international markets. Outside of traditional stocks and bonds, we have added positions in specific diversifying asset classes such as private and alternative credit and trend-following strategies that offer benefits in a multitude of different environments.

The beginning of every new year is a popular time for market prognosticators to opine on the future direction of the market. While we certainly have a view and have positioned portfolios accordingly, we remain humble in our ability to predict the future. The last several years have dealt investors with a seemingly endless list of surprises that have created both risk and opportunity. We suspect this will be the case in 2023, too. It’s important to remain intellectually honest and flexible as the environment unfolds. We consistently advise clients to set a long-term plan and stick to it through the inevitable ups and downs of markets. That advice remains as relevant today as ever.

If you have questions about the capital markets, your individual portfolio, or how your assets are invested, please reach out to your Wealth Manager. We are always happy to take your calls and questions.

Market Commentary Disclaimer

This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.

Professional Designation Minimum Requirements Disclosure

CFA® – Chartered Financial Analyst. Minimum requirements for the CFA® designation include an undergraduate degree and four years of professional experience involving investment decision-making, in addition to successful completion of each of the three CFA level exams.