by Brad M. Weafer, CFA | Chief Investment Officer

by Brad M. Weafer, CFA | Chief Investment Officer

It has become an annual tradition at Boston Financial Management to put together a wish list of all the things we hope to get this holiday season and into the new year. My kids keep getting older, but their Christmas lists keep coming, and so do ours. We hope you can appreciate what we want most this season.

1. Peak Inflation

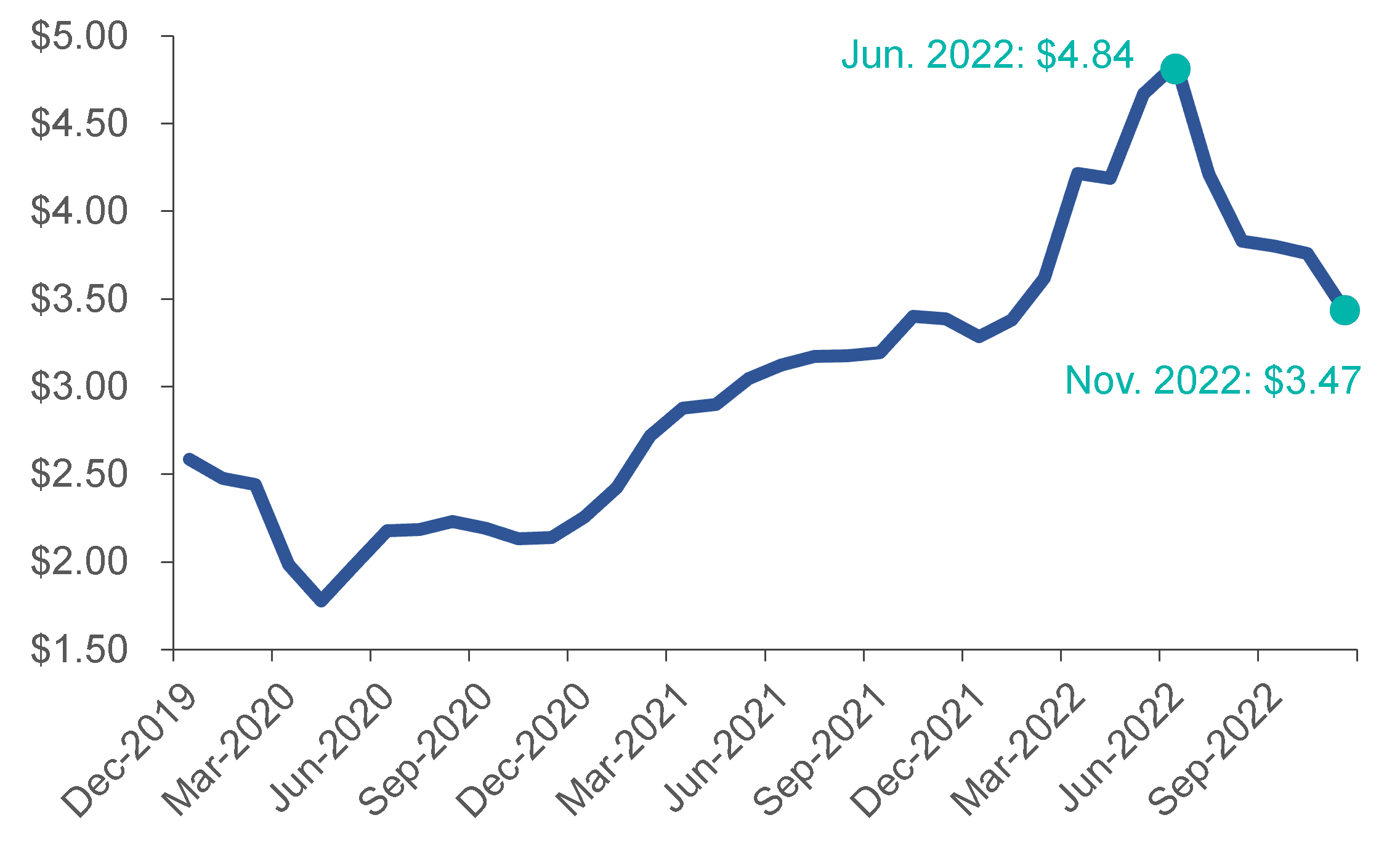

2022 delivered inflation levels not seen since the early 1980s. Recent data fortunately shows signs the worst may be behind us. Key inflation gauges such as the consumer price index (CPI) and producer price index show price growth retreating off the highs in the most recent monthly releases. Numerous other signs corroborate this data. Supply chain stresses have eased meaningfully from heightened conditions earlier this year. Covid-related anomalies like lumber costs and used car price spikes have reversed significantly. Commodity price increases, exacerbated by Russia’s war on Ukraine, have also come down. One pertinent example and important shift – gasoline prices have fallen precipitously since their highs in the early summer and are now flat with prices from a year ago (see Figure 1 below). At the top of our holiday list this year are more benign levels of inflation going forward.

Figure 1: Average U.S. Gasoline Prices (Regular Unleaded)

Source: Bloomberg, Daily National Average Gasoline Prices Regular Unleaded

2. Forward-Looking Monetary Policy

Despite some evidence that inflation pressures are waning, policy pressure from the Federal Reserve continues. Public comments from central bankers suggest they continue to worry about the current level of absolute inflation. We see this stance as akin to driving through the rearview mirror, and hope policymakers realize this error sooner rather than later. There are two main points we hope they consider. First, by their own admission, monetary policy acts with a lag. This tightening cycle began less than a year ago and we are only beginning to see the impacts. To push further on what has already been a historically rapid tightening cycle would surely force the U.S. economy into recession. Second, real-time indicators of price increases most impacted by the Federal Reserve’s higher rates are already showing a major impact. Consider housing; the largest part of the official inflation basket reported by the government is shelter which makes up a whopping 40% of the core inflation basket. According to the official statistics, rent of primary residences rose 0.7% month-over-month in October, accounting for the bulk of the increase. The way shelter inflation is calculated is highly lagged. If policymakers were instead to look at market-oriented statistics updated in real-time, they would be better equipped to make informed policy decisions. Figure 2 below, put together by housing analyst Bill McBride, illustrates the discrepancy. He uses data collected from Zillow and Apartment List that highlights a slowdown in the increase in rents over the last few months relative to statistics included in CPI. Viewing what is happening in the housing market from this lens paints a very different picture of inflationary pressures.

Figure 2: Rent Measure – Year-Over-Year Change

Source: CalculatedRiskblog.com

3. The Return of Bonds as an Attractive Asset Class

Also on our list this year is the hope that bonds have finally returned as a viable source for dependable and attractive investment returns. For the better part of the last decade, interest rates remained stubbornly low by any historical standard. This culminated during the pandemic when the ten-year U.S. treasury yield bottomed at just 0.3%. With bonds offering such little return, many investors took on additional portfolio risk (and added equity exposure) in search of better, if not more volatile, outcomes. Following a historically negative year for bond returns in 2022, purchasing bonds today offers the best prospective return that we have been presented with in many years. Consider just the change from the end of 2021 to today across a wide range of bond options (see Figure 3 below). An investor today can choose from a cash substitute like short-term treasuries yielding greater than 4% to investment-grade corporate bonds yielding over 5% and earn attractive returns with lower expected risk of capital loss.

Figure 3: Average Bond Yield

Source: Charles Schwab, Bloomberg

Indexes represented are: Bloomberg U.S. Aggregate Bond Index (U.S. Aggregate), Bloomberg U.S. Corporate Bond Index (IG Corporates), Bloomberg U.S. Corporate High-Yield Bond Index (HY Corporates), Bloomberg U.S. Municipal Bond Index (Municipal Bonds), ICE BofA Fixed Rate Preferred Securities Index (Preferreds), Bloomberg Emerging Market USD Aggregate Index (EM USD Bonds), Bloomberg U.S. MBS Index (MBS), Bloomberg U.S. Treasury Index (Treasuries), and the S&P 500 Dividend Aristocrats Index (Dividend Aristocrats). Yields shown are the average yield-to-worst except for the Dividend Aristocrats which is the average dividend yield. Past performance is no guarantee of future results. For illustrative purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested indirectly.

4. Productivity Gains

One of the more discouraging economic data points of 2022 has been a marked decline in worker productivity (measured by output per hour). This decline is highlighted in Figure 4 below. The U.S. Bureau of Labor Statistics reports that productivity dropped by over -7% and -4% in the first two quarters of 2022, and only inched up less than 1% in Q3. This phenomenon in part explains why the U.S. experienced soft economic growth this year despite resiliency from the labor market. Productivity is notoriously tricky to measure, but the first two-quarter declines were the largest consecutive declines since the data began to be collected in 1947. Including the small gain in the third quarter, the three-quarter annualized percent change was also the worst reported on record. Opinions vary on the root cause, with working from home, pandemic-related labor hoarding, burnout, and “quiet quitting” often cited with little quantifiable support. Whatever the source, a rebound in productivity would go a long way toward driving the economic growth needed to propel corporate earnings and the equity market higher.

Figure 4: Labor Productivity for All Employed Persons (Nonfarm Business Sector; Change From Year Ago)

Source: U.S. Bureau of Labor Statistics, St. Louis Federal Reserve. Seasonally Adjusted. Change from Year Ago. Indexed to 2012=100

5. Less Market Volatility

The financial markets of 2022 have been hard on clients and professional investors alike. Negative returns for both stocks and bonds tell only half the story. The level of daily portfolio volatility tells the other side. According to AQR Capital Management, through the first three quarters of the year the global stock market exhibited 1.5 standard deviation moves on more than 50% of trading days. This compares to the average going back to 1880 of less than 30% of trading days. Fixed income, normally a stable anchor to balanced portfolios, has also been historically volatile. Implied volatility in rates, as measured by the MOVE Index, has been higher than at any time outside of the great financial crisis, the height of the pandemic, and the bursting of the dot-com bubble. A return to more normal levels of fluctuation in both bonds and stocks would be a welcome gift this holiday season.

6. Stable U.S. Dollar

Another feature of 2022 has been the strong advance in the value of the U.S. dollar, illustrated below in Figure 5. There are a few likely drivers of the rise. While soft in absolute terms, economic performance in the U.S. has been better than in many other parts of the globe, including Europe which is mired in the impact of the Russia-Ukraine war, and China which has been weighed down by its zero Covid policies. Monetary policy in the U.S. has increased rates faster than much of the globe, driving more attractive yields for investors and leading capital flows to those higher yields and the dollars needed to purchase them. There is also likely some level of safety-buying of the world’s reserve currency following heightened geopolitical risks. A strong dollar can be a good thing for the U.S., particularly concerning inflation, as it lowers the cost of importing goods. For investors, however, it is more complicated. For large U.S.-based multinational corporations we own, foreign sales received in other currencies will decrease in value upon translation back into the dollar. Similarly, the investment results of international stocks are translated back to the U.S. at lower rates, making it challenging to achieve outperformance when diversifying globally. A strong dollar also creates challenges for foreign economies that see higher costs in everything from oil to food, lowering overall global growth. Though the dollar is off the peak from a month or so ago, some level of price stability would go a long way to easing the challenges on global markets and the economy.

Figure 5: U.S. Dollar Index

Source: Bloomberg

7. Happy and Healthy New Year

The markets have not been easy this year. The holidays fortunately offer a time to remember exactly what is most important. While we too hope for better investment returns in 2023, we wish even more for the health and happiness of all our clients and colleagues. All of us at BFM sincerely wish all of you a very happy holiday.

Conclusion

It’s important to note that while this list highlights our hopes for the coming year, as a firm we operate in the world as it is, not as we wish it was. Our investment team positions client portfolios in a manner that addresses a variety of risks and opportunities across the capital markets. The scenarios we’ve outlined here would be advantageous, but we are ready regardless of what the future may hold.

The team at Boston Financial Management is always available to answer your questions. Please do not hesitate to contact your Wealth Manager directly or call our main line at 617-338-8108. We look forward to getting together in person in the new year!

Financial Pages Disclaimer

This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.

Professional Designation Minimum Requirements Disclosure

CFA® – Chartered Financial Analyst. Minimum requirements for the CFA® designation include an undergraduate degree and four years of professional experience involving investment decision-making, in addition to successful completion of each of the three CFA level examinations.