Along with the rest of the world, we are watching with sadness and dismay as the Russians invade Ukraine. Our hearts break for the Ukrainian citizens, and it is a powerful reminder of how fortunate we are as Americans to enjoy the geographic and military security of the United States. Unsurprisingly, a geopolitical event like this can have far-reaching consequences, and clients are rightfully asking how BFM is positioned and responding to the current crisis.

First and foremost, clients have little-to-no direct exposure to the Russian economy, which will be damaged by large-scale and coordinated sanctions, and we have no plans for this to change. Relative to global benchmarks, BFM clients also have far less exposure to European economies, which have more reliance on Russia for imports/exports than the U.S. and thus are more at risk of being tangentially impacted by Russian sanctions.

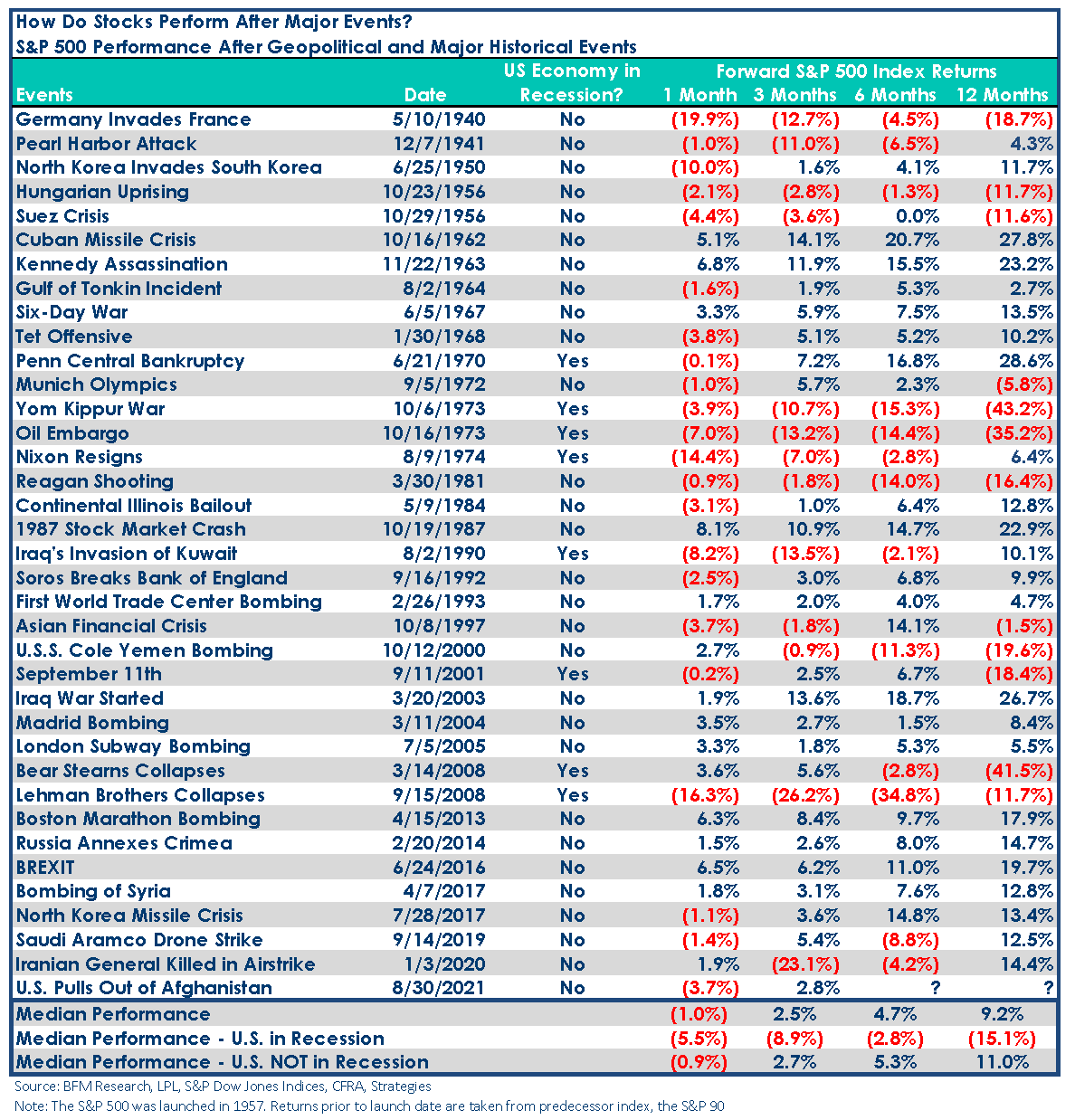

But a geopolitical crisis adds further uncertainty to U.S. markets already battling tightening Federal Reserve policy, supply chain challenges, and continued Covid worries. This is reflected in the market’s weakness so far this year, with the S&P 500 down -9.8% through February 24, 2022. But despite yet another brick in the proverbial “wall of worry,” history suggests geopolitical crises are transitory events for markets. Looking at dozens of events over the last 80 years, the median performance of the S&P 500 is up over the 6-month (+4.7%) and 1-year (+9.2%) periods following a crisis (see table below). Excluding recessionary periods, the data is even more supportive, up +5.3% and +11.0%, respectively.

As we have stated in the past, what matters more for stocks is the path of earnings, as well as interest rates and Fed policy, and current forecasts for the S&P 500 continue to point to growth in 2022. One area we are watching is whether rising gasoline prices brought about by the Russian invasion impact consumer spending, but with labor markets and consumer balance sheets strong, our base expectation is another year of earnings growth. Beyond that, our high-quality focus generally leads to owning businesses with more durable earnings growth and an ability to overcome bumps in the road should our forecast prove optimistic.

Finally, volatility and market dislocations often provide opportunities to purchase high-quality stocks at attractive valuations. The BFM Analyst Team is hard at work searching for such opportunities to help clients not only weather current events but to take advantage of them.

The team at Boston Financial Management is always available to answer your questions. Please do not hesitate to contact your wealth manager directly, or call our main line at 617-338-8108.

CFA® – Chartered Financial Analyst. Minimum requirements for the CFA® designation include an undergraduate degree and four years of professional experience involving investment decision-making, in addition to successful completion of each of the three CFA level examinations.

by

by  by

by