by Brad M. Weafer, CFA | Chief Investment Officer

by Brad M. Weafer, CFA | Chief Investment Officer

Key Points

- Investors have been dealt a painful reminder in January that corrections can and do happen with some regularity

- While the decline has been uncomfortable, there are positive signs looking forward for the economy and market

- Despite recent weakness, equity returns have been stellar over recent years and equity weightings may be ahead of planned targets

- Now is a great time to review those goals and rebalance portfolios where necessary

If a lack of volatility in U.S. equity indices was the hallmark of the calendar year 2021, the first three weeks of 2022 have proven the opposite. After notching a new all-time high on the second trading day of the year, the S&P 500 fell over 12% before rebounding during volatile trading this Monday. The index is now down 7.5% year to date (as of January 25, 2022). Other major indices have also had rapid declines. The technology-heavy NASDAQ Index and Russell Small Cap Index both fell nearly 20% from recent highs. Results under the surface of the index returns have been even more jarring. Riskier segments of the market have been hit hard. The Goldman Sachs Non-Profitable Tech Index is down 20.6% year to date and has declined by more than 50% from February 2021 highs. According to research firm Sentiment Trader, 42% of Nasdaq stocks have now been cut in half from their 52-week highs. Only the financial crisis and Covid panic in March of 2020 saw more stocks fall by 50% or more. Given that the S&P enjoyed a 28.7% total return in 2021 and 11% in the fourth quarter alone, some might claim we were “due” for an increase in volatility, but nobody could blame you for being disoriented by the swiftness of this decline. The S&P has only fallen 10% from an all-time high faster on three other occasions in history (Source: LPL Financial).

Why is this Happening?

The current combination of high inflation and low unemployment is forcing the Federal Reserve to move away from the accommodative monetary stimulus adopted since the beginning of the pandemic. Policymakers face the difficult choice of acting aggressively to curb inflation at the expense of providing less support for growth. Government bond yields have moved higher in response to those expectations, with the ten-year treasury yield reaching a high of near 1.9%, the highest level since before the onset of Covid. Rising rates weigh on equity valuations that were already at stretched levels relative to history. At the same time, the prospect of diminished fiscal support from government programs could mean the central bank is starting to tighten just as the economy begins to cool off relative to quite strong recent levels. Softer economic readings in January, likely the result of the Omicron infection wave, have added to the negative shift in sentiment. Add escalating military tensions in Ukraine, and the recipe for stock market weakness came together quickly.

“It is like Déjà vu All Over Again”

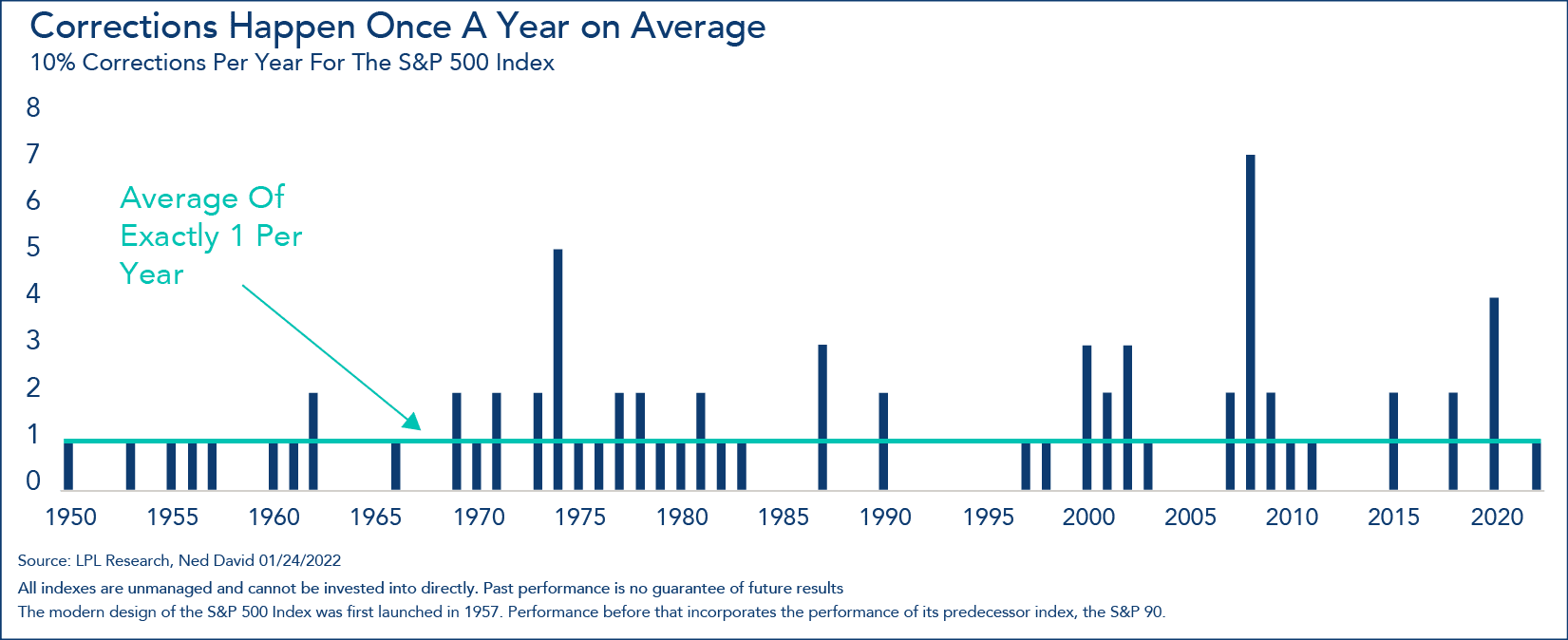

Many market participants have short memories. As noted above, volatility was largely absent from the market in 2021, with no drawdowns from a recent high of more than 5%. And despite experiencing a once-in-a-lifetime pandemic, the S&P has returned 20% a year for three years and 16% a year over five years, a remarkable run relative to the approximately 10% per year the market has averaged historically. The recent outsized results have almost lulled us into a false sense of security. Normally, the stock market does have corrections of 10% or greater (once a year on average since 1950, see Figure 1 below). The average year has actually experienced an intra-year decline of 14%. It is only human to feel anxious during these types of market declines, but it should provide some solace that this activity happens with regularity.

Figure 1.

Is There Any Good News?

When stocks are falling, it is easy to focus on the negative, but there are green shoots that we see as important to help keep confidence amidst falling prices. A review of history suggests stocks and earnings rarely fall into bear market territory without the onset of an economic recession. Signs of imminent economic declines are largely absent today. While recent readings of U.S. economic data have been generally disappointing versus expectations, most economists are still calling for significant economic growth in 2022, with a consensus forecast of 4% GDP growth. Another positive sign is that the reported infection rates for the Omicron variant have shown indications of being past peak and are beginning to decline in major metro regions in the northeast. This suggests some of the recent malaise may prove temporary. The labor market remains strong, and consumer balance sheets are quite healthy as well. Growing corporate profits generally accompany economic advances, and consensus estimates imply over 8% increases in S&P 500 earnings per share. This is all supportive of a healthy stock market and better gains to come following the downside witnessed thus far.

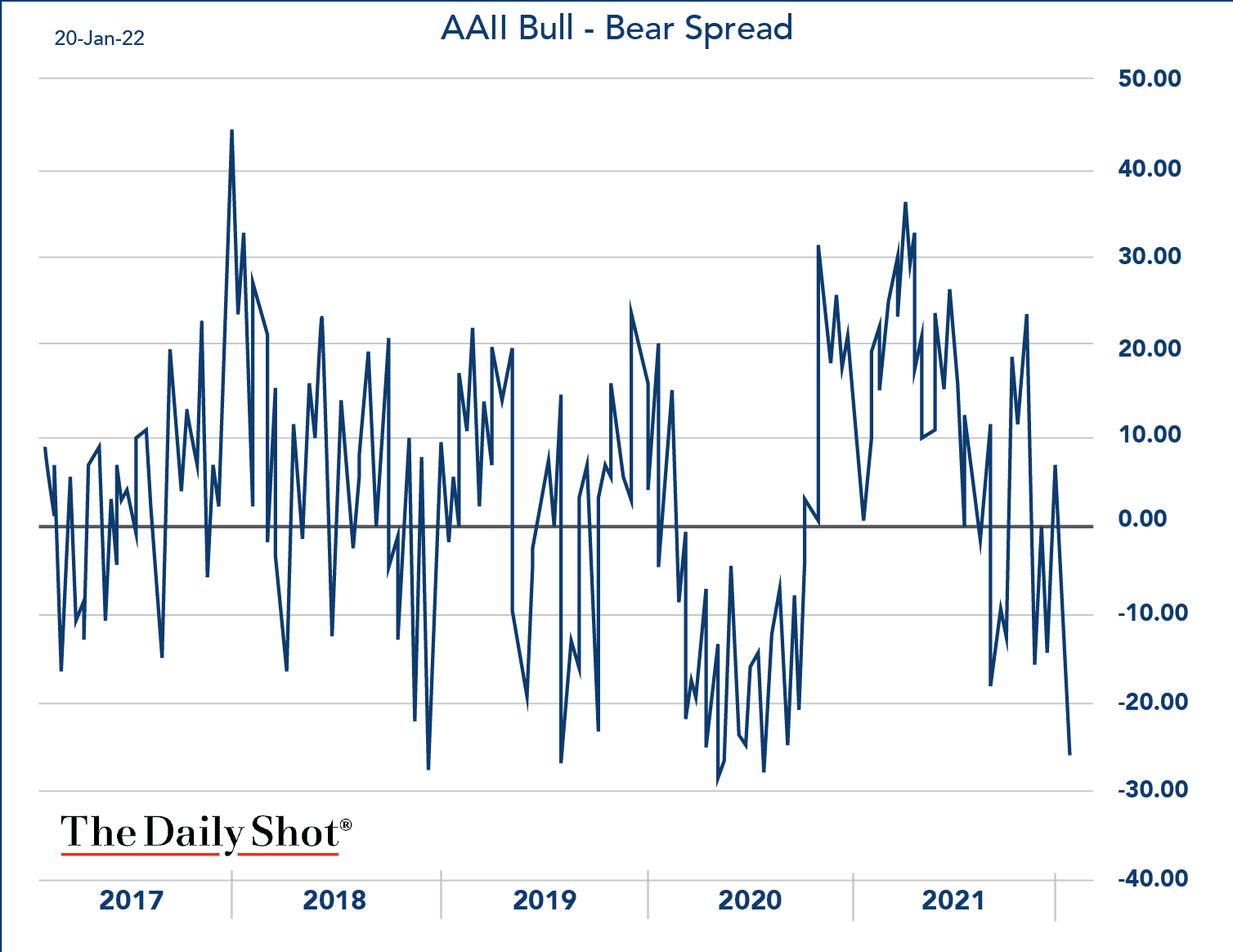

Away from fundamentals, sentiment has shifted decidedly negative, a contrarian positive sign. Bullish sentiment in the American Association of Individual Investors (AAII) Sentiment Survey fell this week to its lowest level since July 2020. Meanwhile, bearish sentiment rose to its highest level since September 2020. Bears outnumber bulls by the largest margin since mid-2020 (see Figure 2 below). Bullish sentiment measures the percentage of individual investors that expect stock prices to rise over the next six months. Bearish sentiment measures the percentage of individual investors that expect stock prices to fall over the next six months. Historically, the S&P 500 has performed well during the 6- and 12-month periods following unusually low bullish sentiment readings. Since July 1987, when the level of bullishness in the AAII Sentiment Survey was more than one standard deviation below its historical average (like today), the S&P 500 has realized 6-month average gains of 8% and 12-month gains of nearly 15%1. The S&P 500 has risen 82% of the time following an unusually low bullish sentiment reading versus 75% for all 6-month periods2.

Figure 2.

Is There Anything We Should Do?

When stock market drama occurs and investor anxiety rises, it is a good time to take stock of how portfolios are allocated and what level of risk is appropriate. With the help of your BFM team, you have already developed a plan that matches your ability and willingness to tolerate risk and meet your investment goals. After a decade of above-average equity returns, it may be no surprise that many investors have a higher weighting to equities than ever before. The latest fund manager survey from Bank of America reported an all-time low of 7% of managers were underweight stocks relative to targets. While current bond yields do not offer attractive return prospects, the current equity drawdown is a good reminder of why we suggest diversifying across asset classes to help manage risk and volatility. Steady rebalancing and a thoughtful approach to asset allocation are needed to keep portfolios on track.

CFA® – Chartered Financial Analyst. Minimum requirements for the CFA® designation include an undergraduate degree and four years of professional experience involving investment decision-making, in addition to successful completion of each of the three CFA level examinations.