Boston Financial Management (“BFM”) has been awarded a PSN Top Guns distinction by Informa Financial Intelligence’s PSN manager database, North America’s longest running database of investment managers.

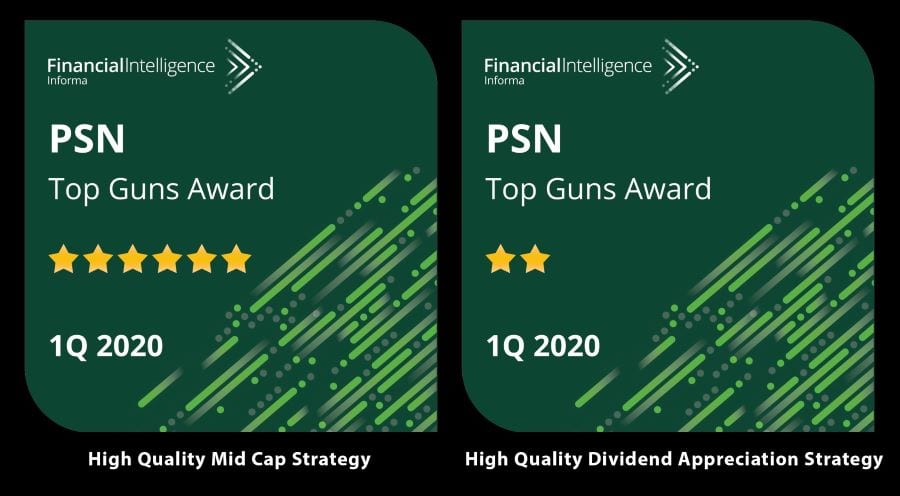

BFM was honored with a 6-Star Top Gun rating for our High Quality Mid Cap strategy and 2-Star Top Gun rating for High Quality Dividend Appreciation strategy.

“We are very pleased to be recognized and receive PSN’s designations as top performers in our domestic equity peer universes”, says Brad Weafer, CFA, Chief Investment Officer. “Our team follows a disciplined process seeking to own a concentrated selection of highest quality companies, with durable competitive advantages, excellent profitability, and strong and stable growth outlooks. We are very happy that our results have benefited our clients’ total returns and financial goals.”

PSN Top Guns ranks products in six proprietary categories in more than 50 universes and is a resource for institutional asset managers and investors in their decision-making process. Top Gun firms are awarded a rating ranging from one to six stars, with the number of stars representing continued performance over time.

BFM’s High Quality Mid Cap strategy was named Top Gun 6-Star rating, meaning the strategy was one of the top ten performers in our peer group over the most recent five-year period. Moreover, products must have returns greater than the style benchmark for the three latest three-year rolling periods. Products are then selected which have a standard deviation for the five-year period equal or less than the median standard deviation for the peer group. The top ten information ratios for the latest five-year period then become the 6 Star Top Guns.

BFM’s High Quality Dividend Appreciation strategy was named Top Gun 2-Star rating, meaning the strategy had one of the top ten returns for the one-year period in its respective universes.

BFM’s High Quality Mid Cap strategy focuses on small and mid-sized public companies that possess strong competitive positions, where the quality or growth potential has gone unnoticed or underappreciated. Likewise, in the High Quality Dividend Appreciation strategy we look for similar companies that also pay a strong and growing dividend. Both portfolios are concentrated, generally holding only 20-30 companies, allowing us to focus our research efforts on our best ideas. We favor businesses with positive cash flow, capable of earning high returns on invested capital, with attractive growth prospects.

“Congratulations to Boston Financial Management for being recognized as a PSN Top Gun,” said Ryan Nauman, Market Strategist at Informa Financial Intelligence’s Zephyr. “This highly esteemed designation allows us to recognize success, excellence and performance of leading investment managers each quarter.”

The complete list of PSN Top Guns and an overview of the methodology can be located on https://psn.fi.informais.com/

About Informa Financial Intelligence’s Zephyr

Financial Intelligence, part of the Informa Intelligence Division of Informa plc, is a leading provider of products and services helping financial institutions around the world cut through the noise and take decisive action. Informa Financial Intelligence’s solutions provide unparalleled insight into market opportunity, competitive performance and customer segment behavioral patterns and performance through specialized industry research, intelligence, and insight. IFI’s Zephyr portfolio supports asset allocation, investment analysis, portfolio construction, and client communications that combine to help advisors and portfolio managers retain and grow client relationships. For more information about IFI, visit https://financialintelligence.informa.com. For more information about Zephyr’s PSN Separately Managed Accounts data, visit https://financialintelligence.informa.com/products-and-services/data-analysis-and-tools/psn-sma.

Disclosure

Rates of return referenced above may not be representative for any one client’s experience because they reflect the averages for all clients in the BFM High Quality Dividend Appreciation Strategy and the BFM High Quality Mid Cap Strategy, respectively. Past performance is not indicative of future results. It should not be assumed that future performance of any investment strategy in this presentation will be profitable or will correspond to any index or past performance.

BFM did not pay a fee to be considered for the Top Guns award, but did pay a fee of $2,000 to use the above PSN exhibits once we were awarded with the designations.

¹ free registration to view Top Guns