by Brad M. Weafer, CFA Chief Investment Officer

by Brad M. Weafer, CFA Chief Investment Officer

Financial markets have been rattled in recent days as the number of new coronavirus cases outside of China has continued to grow. In prior weeks, investors had shown signs of complacency, and sentiment propelled stocks higher for the first 7 weeks of 2020. However, coronavirus-driven fear has brought expectations back down rather quickly. The S&P 500 declined 7.8% from all-time highs reached just Thursday of last week. Investors rushed to the safe-haven of U.S. treasuries, sending the yield on the 10-year U.S. Treasury note to a record low of 1.32%.

The number of new coronavirus cases in China has actually dropped dramatically at the same time, but travel restrictions and pandemic fears have threatened both growth in the Chinese economy and the global supply chain of multinational corporations. Any economic slowdown or lasting impact on supply chains puts profit estimates for this year at risk. Individual companies with more exposure to China and other directly affected industries have seen their stocks suffer the most. We have started to see companies lower their profit guidance in response.

We would agree that the virus and fear of the virus will slow economic growth in the short-term. The magnitude of the decline is still a question, and estimates of the disease’s economic impact are largely educated guesses and vary widely. To date, there is little sign the virus is having any noticeable impact on U.S. economic growth. To the extent a slowdown hits world economies, we would also expect policy makers to react. In China, actions have already been taken to stimulate economic activity and free-up credit. In the U.S., while we expect the Federal Reserve would prefer to keep rates steady as recently communicated, particularly in an election year, any additional weakness as a result of the coronavirus could force their hand.

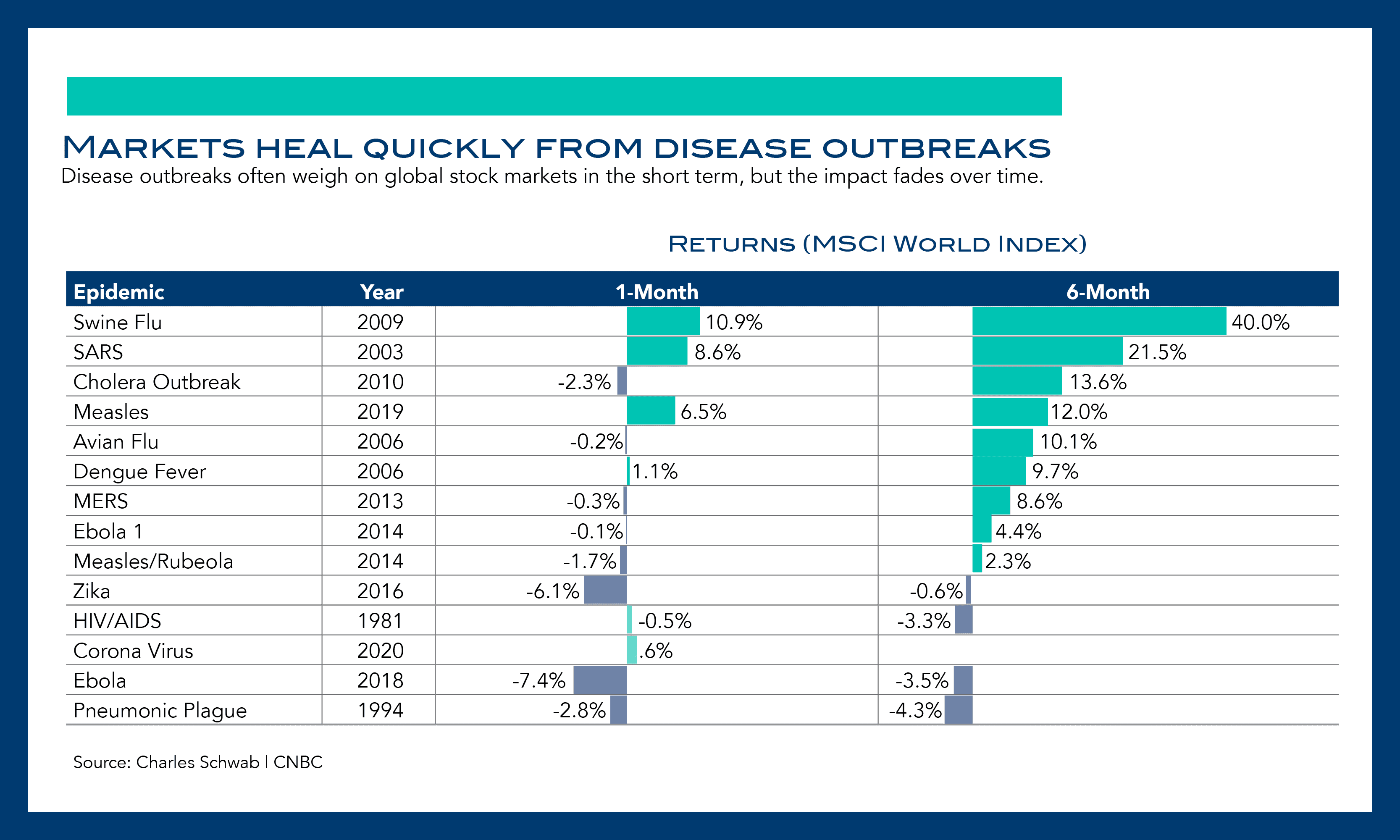

The coronavirus is not the first health scare that has affected economies and markets. Historical precedence suggests the impact on markets and economies of these types of disease outbreaks is transitory. In a note Tuesday, Jeff Kleintop of Charles Schwab highlighted this phenomena using a number of past episodes (see chart below). It is also important to put the disease in context. The latest data suggests global coronavirus-related deaths total near 3,000, mostly in China, while the CDC reports there have been 16,000 deaths in the U.S. this year due to influenza.

What is BFM doing in response?

As we have previously communicated, we have proactively taken steps to reduce areas of cyclical exposure in portfolios over the course of the last year. Into 2020, following the strong performance of equities, we have advocated clients re-balance their mix of riskier assets (like stocks) and safe assets (like bonds), more in line with long-term targets. A disease outbreak was not on our watch list of expected risks, but we did have a growing unease with the level of complacency markets were exhibiting. From here, we continue to expect volatility, but the economic and market impacts to prove transitory. We are evaluating the effects on individual companies within portfolios to source opportunities and potential areas of risk. In moments of investor panic like this, we are very happy we own individual companies where we can analyze the idiosyncratic impact, rather than speculating on the impact on a broad index of stocks. We don’t suggest rash action, but we will continue to make thoughtful decisions to grown and protect our clients’ capital.

Market Commentary Disclaimer: This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.