Brad Weafer, CFA, Chief Investment Officer

Brad Weafer, CFA, Chief Investment Officer

Key Points:

- Equity markets have been eerily calm thus far in 2017

- History suggests investors shouldn’t get too comfortable, corrections are normal occurrences

- Investors are prone to panic when equity markets fall, reducing their long-term returns

- Controlling emotions and proactively managing risk is the best way to ensure long-term investment success

One would think 2017 has been a rather boring year if only focused on stock price movement. The U.S. stock market has made a monotonous march higher, reaching all time highs and notching near double digit returns in the first six months of 2017. Surprisingly, the most commonly used measure of risk, volatility, is at historic lows. Experience tells us usually calm markets like this don’t last forever and we should prepare for volatility to increase. These are the exact moments when investment managers provide their greatest value to passive approaches. Employing careful security selection, we seek companies with a high degree of insulation from risk. When times are good, risk management seems unnecessary. When times shift more negative, the full value of an active approach is realized. Equally, if not more importantly, one of the key benefits we provide as professional advisors is helping clients manage through periods when fear increases and the immediate reaction is to panic and sell. History demonstrates that thoughtful risk management and keeping emotions in check leads to better long-term investment outcomes. Individual investors who follow this prudent advice do measurably better over time.

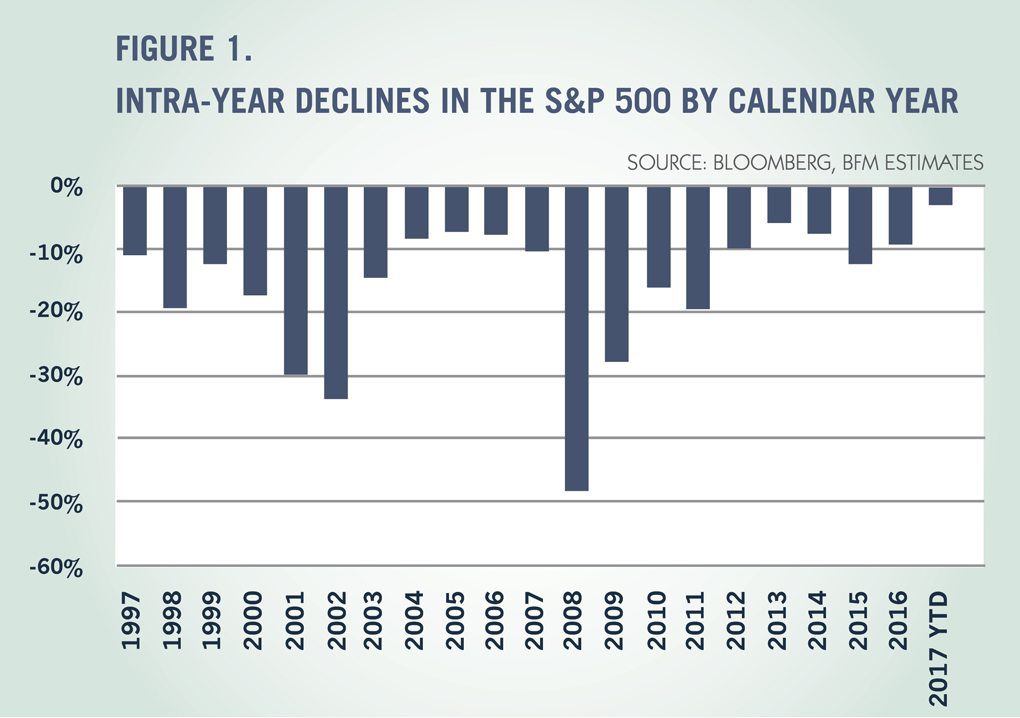

LACK OF VOLATILITY

Thus far in 2017, equity markets have been remarkably placid. According to Goldman Sachs, the S&P 500 index’s volatility has reached levels not seen since 1966. Expected volatility is 35% lower then the 15-year average (as reported by Barron’s). Even more telling, the largest intra-year decline this year is only 2.8%. Using the last 20 years as a proxy, the market has had an average annual intra-year decline of 16%! In all twenty years we witnessed declines over 5% and in thirteen years we saw declines of greater then 10% (see Figure 1 below). This suggests an increased level of turbulence is likely. It is normal for equity markets to exhibit variability but that does not mean that declines must be significant or long lasting. Even though there were double digit declines in thirteen of the last twenty years, in only four of those years was the annual return negative. The index averaged an annual total return of 7.3% for the full twenty year period. What would have happened had investors panicked and sold following those 10% declines? They would have missed the average prospective three-year return of over 10%!

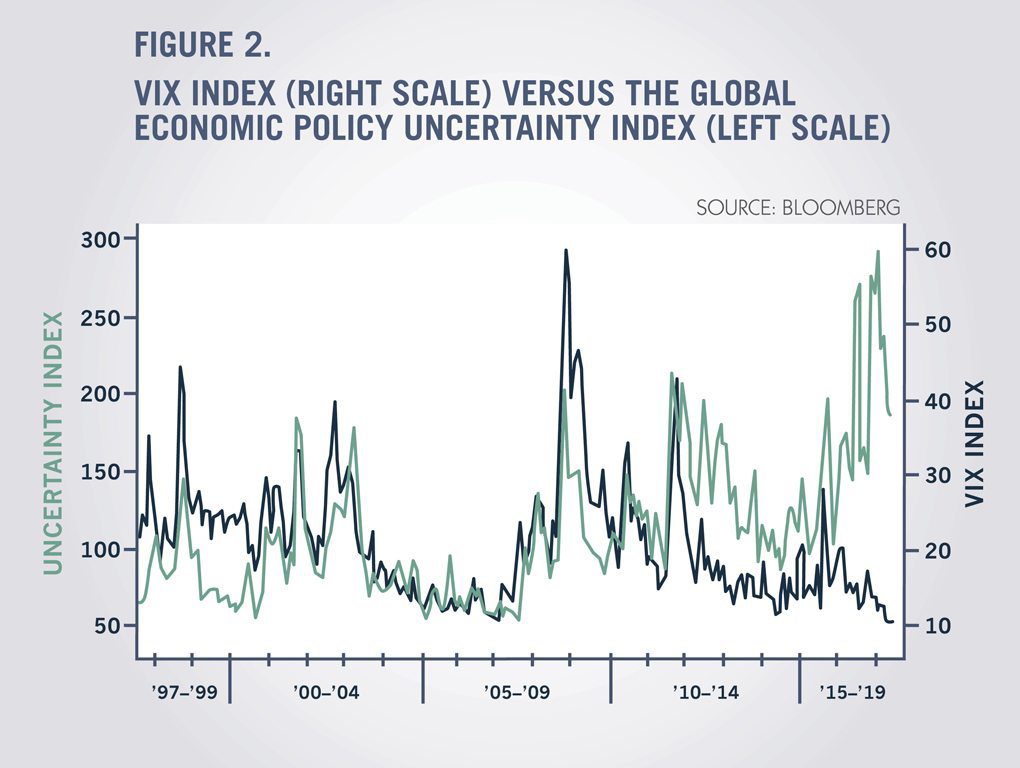

UNCERTAINTY LEVELS NOT REFLECTED IN MARKET VOLATILITY

Subtle equity markets are in a strange juxtaposition relative to the sentiment we hear from clients and other professional investors. Whether it is stories of dysfunction in Washington, two interest rate hikes from the Federal Reserve, or geopolitical tensions on the rise, we sense many people are uneasy. We see evidence of this when comparing the Chicago Board of Options Exchange Volatility Index, a gauge of investor anxiety known as the VIX, and the Global Economic Policy Uncertainty Index (see Figure 2 below). Historically, the two indices have tracked each other with a reasonably high degree of correlation, which makes intuitive sense. Over the course of the last year, however, a significant divergence has developed, providing another data point that implies volatility is likely set to rise.

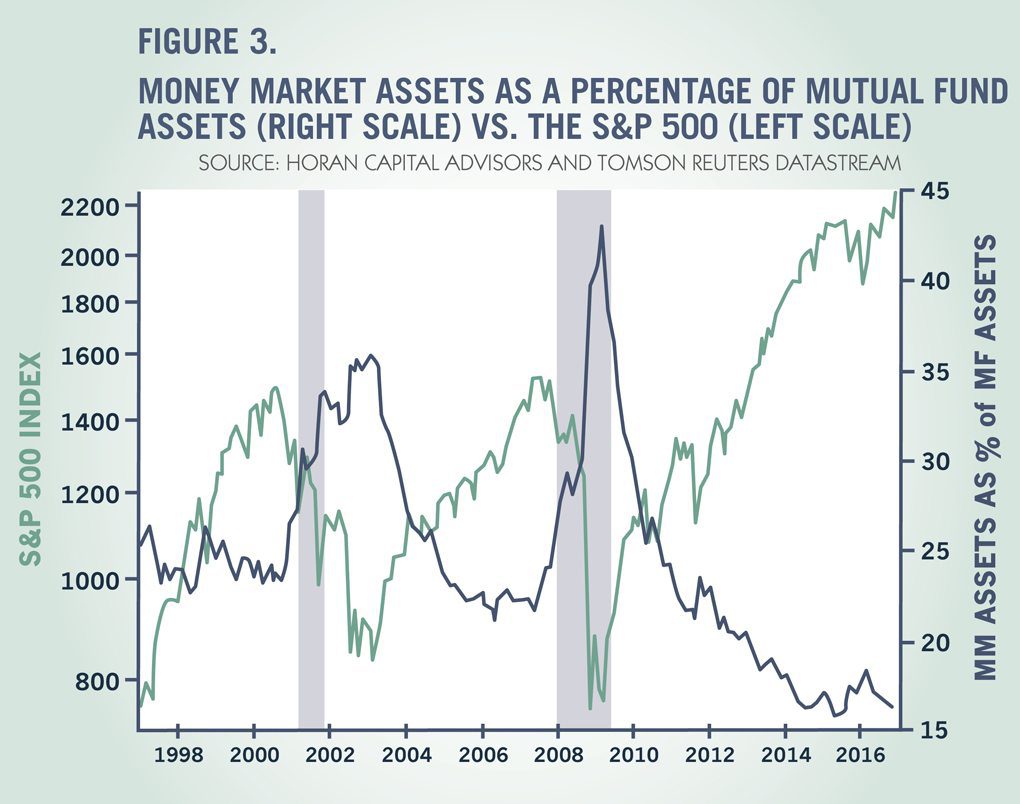

SELLING LOW AND BUYING HIGHER

Unsurprisingly, increased volatility and market declines are generally met with investor anxiety. In future market corrections we expect a great number of investors will panic and sell after declines. The last two bear markets provide stark examples. During both large market draw-downs, the percentage of assets in money market funds increased markedly relative to total mutual fund assets, peaking near equity market lows (see Figure 3 below). Investors effectively sold stocks at the lowest prices. Those investors who “went to cash” to ride out the storm failed to fully participate in ensuing recovery, only gradually reinvesting after prices went higher.

HUMANS ARE HARD WIRED TO BE POOR INVESTORS

Why is it that investors often let their emotions get the better of them? Unfortunately, researchers show humans are hard wired to invest poorly. Daniel Kahneman, a psychologist who won the 2002 Nobel Prize for Economics, is one of the foremost authorities in behavioral economics. His work provides insights into human judgement and decision-making under uncertainty. According to his studies, the way humans process and remember information, problem solve, and make decisions is influenced by cognitive biases. These biases don’t always result in the most accurate or best outcomes, but have evolved to our greatest survival benefit and are most efficient in terms of time and energy expenditure. Our “fight or flight” reaction may be our best-known expression of survival instinct. This is germane to investors who have an almost “reflex-like” emotional reaction to seeing price declines in their portfolios. People are quick to decide the solution is to sell, despite historical evidence showing that is the sub-optimal choice. Kahneman has also done significant work on loss aversion, which suggests people feel greater distress from losses than the enjoyment they receive from gains. His research finds that people tend to feel a loss about twice as severely as they experience a gain. The implication is that in investment action, investors will try to avoid a loss much more than they will try to pursue a similar gain. These two biases put investors at a disadvantage that we must acknowledge and for which we must prepare.

SUCCUMBING TO FEAR REDUCES RETURNS

Research firm Dalbar analyzes the impact this type of investor behavior has on total returns (source Dalbar’s “Quantitative Analysis of Investor Behavior”). In their words, they “measure the effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long-term time-frames.” The results of their analysis have consistently shown that the average investor earns less than professional manager returns because of untimely buying and selling of selected investment strategies. While the active investment management industry has come under pressure from passive alternatives, these studies suggest that investment results are more dependent on investor behavior rather than on the performance of the manager. Their studies indicate the average investor’s annual returns lag the S&P 500 index by 3.5% per year. Calendar year 2016 presents a fresh example of what can happen. The stock market achieved all-time highs but geopolitical events, including Brexit and the U.S. Presidential election, gave investors reasons to fear what might happen to their portfolios. For the full year, the index returned nearly 12%, but the average investor realized only a 7.3% return, a 4.7% gap. During 2016, equity markets went through significant short-term dislocations, all of which proved poor times to sell.

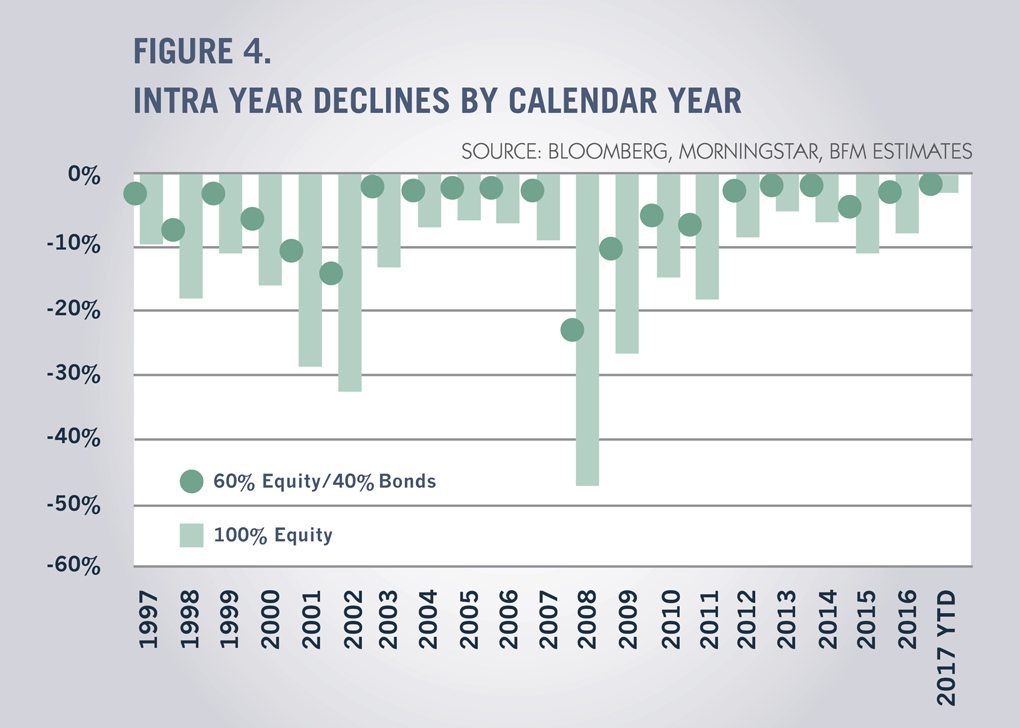

HOW DO WE PREPARE?

One of our key roles as professional advisors is to work with clients to develop long-term goals and to set appropriate asset allocation plans to meet those goals. Part of that process requires evaluating the risk tolerance of the individual, recognizing that at some point, market stresses will likely challenge most investors to stay true to their long-term plan. A simple yet effective tool to managing risk is diversifying assets to include some form of portfolio protection that will preserve capital in stock market downturns. For example, portfolios with a 60% allocation to stocks and a 40% allocation to fixed income saw intra-year declines less than one half that experienced in all equity portfolios (see Figure 4 below). Those balanced portfolios would have returned slightly less (6.8% annually vs. 7.3%), but the probability an investor stayed on course through all the ups and downs would be much higher. Positioning portfolios to withstand volatility and helping clients stay on track are among our highest priorities.

This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.

Will You Still Need a Trust if the Estate Tax is Repealed?

by Kathy Sablone, Director of Wealth Planning

Proposals to repeal the estate tax are looming and many of our clients have asked whether they still need trusts in their estate plans. For most people, the answer is yes because of the many non-tax reasons to use a trust.

One major benefit is that a funded trust provides more consistent and efficient management upon your death or incapacity. Unlike assets that pass through your will, assets owned by the trust avoid probate, which keeps the details private. In addition, avoiding probate can save your estate time and money. A funded revocable trust also provides continuity; a successor trustee can serve immediately upon your death, whereas a personal representative or executor does not have any authority until appointed by the probate court. Similarly, if you become incapacitated, your successor trustee can manage the trust assets on your behalf without going to court to obtain guardianship or conservatorship.

Another reason to use a revocable trust is to protect your heirs. Without a revocable trust, your beneficiaries may receive their inheritance outright. A minor beneficiary may spend unwisely and squander his or her inheritance without the protection of a trust. A beneficiary with special needs may be disqualified from government benefits by the inheritance. If you are in a second marriage and your assets pass directly to your surviving spouse, your children could be disinherited. In contrast, a trust can be structured to give a trustee the discretion to make payments to beneficiaries according to your plan, provide creditor protection, and direct when and how the trust terminates.

Finally, even if the federal estate tax is repealed, many states will continue to assess a state estate tax or inheritance tax. A trust can contain a formula that takes advantage of any available exemptions and deductions to minimize, or even avoid, state estate taxes.

At this point, no one can predict what will happen to the federal estate tax. We advise making sure your estate plan is flexible so it works in a variety of tax situations. If you have any questions about how you, your family, or other beneficiaries could benefit from a trust, please contact your Boston Financial Management advisor.

Important: This article does not contain any legal or tax advise. You should always consult with your attorney, accountant or other professional advisors before changing or implementing any tax, investment or estate planning strategy.

IRS Circular 230 Disclosure: Pursuant to IRS regulations, we inform you that any tax advice contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax related penalties or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

Please Note: Examples shown are for illustrative purposes only and do not represent the performance of any account, portfolio, composite of accounts or specific recommendation of Boston Financial Management. Your actual performance will vary based on your particular circumstances and should be adjusted to reflect management fees and trading costs. Investment in securities involves risks, including the risk of loss of principal. Past performance is not a guarantee of future returns.