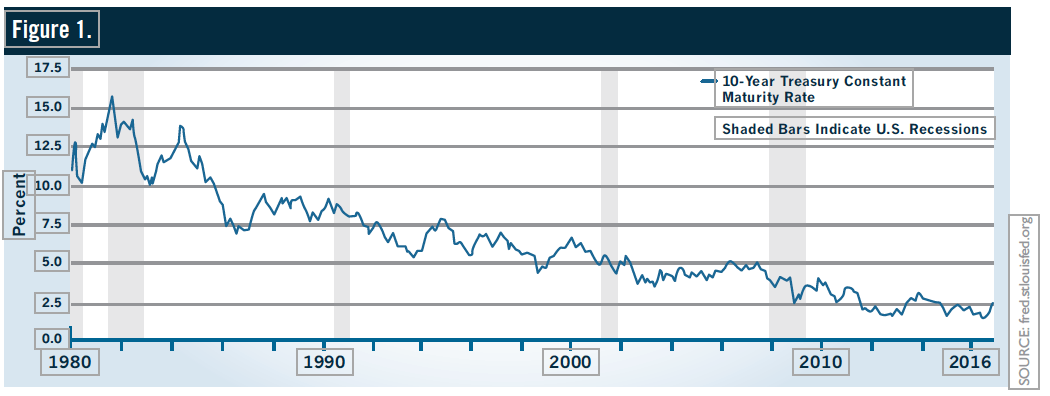

Interest rates have been in a secular decline for 35 years. November 2016 signals the low in yields and is depicted in the 10-Year Constant Maturity graph in Figure 1. The chart below depicts this decline since 1980. For those who may not remember, Paul Volker was appointed head of the Federal Reserve in August 1979 when inflation had soared (the peak in CPI was 14.8% in March 1980). Volker increased the Fed Funds rate to 20% by June 1981 in order to break inflation expectations. Does anyone remember the Prime Rate during that period? It peaked at 21.5%! Of course, a recession ensued but interest rates began a long secular decline. The 2008 credit crisis and recession were just one stop on the way to historic lows in interest rates.

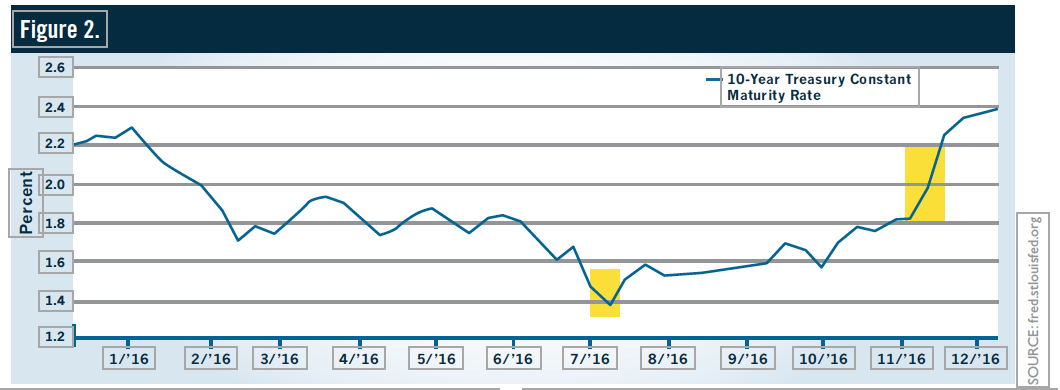

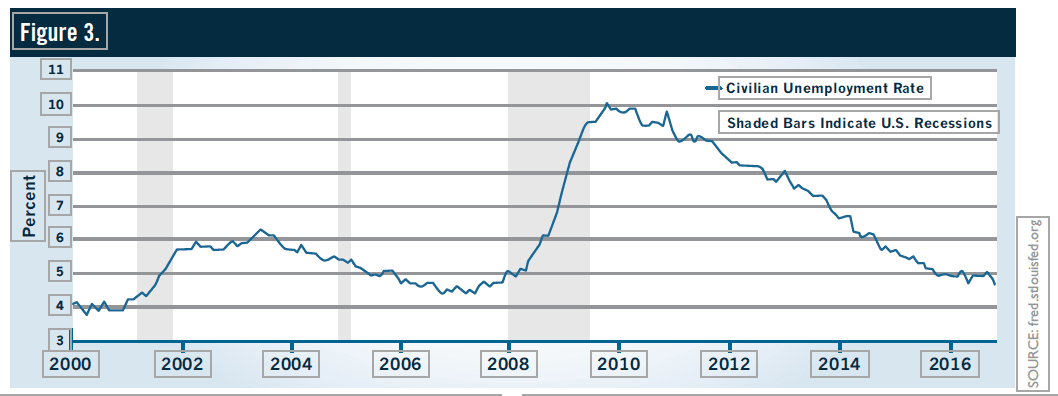

More recently, interest rates moved higher off the Brexit lows in July 2016 (see yellow in middle of Figure 2 on top of page two). Bonds rallied (rates fell, prices rose) on panic after the United Kingdom referendum to leave the EU passed. However, after that panic, the bond market became increasingly confident in the fundamentals of the US economy. The market recognized the Fed was poised to raise rates again. The judgment of the Fed was the U.S. economy was in much better shape to sustain another increase in short-term interest rates. The Fed has wanted to move off the zero boundary on the Fed Funds rate for a long time. The first move in December 2015 took the target rate to 50 basis points (0.50%) and the Fed has been telegraphing a message that the economy was stronger, particularly as measured by the labor statistics (unemployment rate approaching lows seen in the bull market that ended with the technology stock selloff in 2000. (See the Figure 3 below).

The bond market had priced in a move by the Federal Reserve to increase rates at the December 14th meeting and accordingly, the FOMC voted unanimously to increase the overnight lending rate to 0.75% (actually, this operates in a range of 0.50%-0.75%). The Fed noted inflation expectations have risen and the labor market is tightening. Further increases in the Fed Funds rate are expected in 2017.

However, what the bond market had not priced in was a Trump victory. The November 8th election upended assumptions about deficits, debt, and inflation. The immediate reaction in the bond market was for prices to decline and interest rates to rise. (See the yellow highlight on the right hand side of Figure 2.) Why would this happen? The new administration has telegraphed that it is willing to let deficits rise which increases the size of the federal debt. In addition, the incoming administration is saying it wants increased infrastructure spending ($1 Trillion dollars) but alas, taxes will be cut which always makes the bond vigilantes nervous. Increased spending and decreased revenues are not a recipe for interest rates to remain at historic lows. In addition, the labor market is tight, with wage inflation a risk and much of what the incoming administration has proposed, from a fiscal policy point of view, is inflationary. We can add on concerns about trade wars, which at the very least stand to increase the prices consumers pay for discretionary and nondiscretionary goods.

The backdrop for the change in sentiment post-election is that for many investors, a secular rise in interest rates is an unknown. Investors that need income have moved into stocks (dividend yields as a bond proxy), gone long in duration (maturity), invested in high yield, and emerging market debt.

With interest rates at extraordinary lows, a move to higher yields will be painful if you are exposed to long duration and emerging market debt (do not forget the impact of a strong dollar and tariffs).

There is no method of escaping the effects of higher interest rates. All portfolios with bond exposure will see some market price decline when interest rates rise. However, to the extent durations are short the bond allocation is doing its job. High quality bonds are not meant to be a capital appreciation vehicle. They are there to provide a predictable source of income and to protect against principal loss. Portfolios will be able to capture some of the move to higher interest rates as maturing bonds are redeployed.

Market Commentary Disclaimer: This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.