by Brad M. Weafer, CFA | Chief Investment Officer

Out of night comes day, and out of day comes light

Click Video Below for Quarterly Update

Key Points

- Traditional asset classes have suffered this year due to inflation, increasingly restrictive central bank policies, and their associated impact on the global economy.

- The economy appears to be slowing and corporate profits look vulnerable as a result. Our investment strategies are positioned in a somewhat cautious manner to address short-term volatility.

- Despite a challenging year, several of our decisions have helped moderate losses including holding short-duration fixed income, exposure to alternative assets, and a bias towards U.S. securities. In contrast, allocating to high-quality companies and exposure to mid and small-cap companies have hindered performance.

- Despite some near-term caution, several asset classes are now much better priced for long-term returns.

Third Quarter Recap

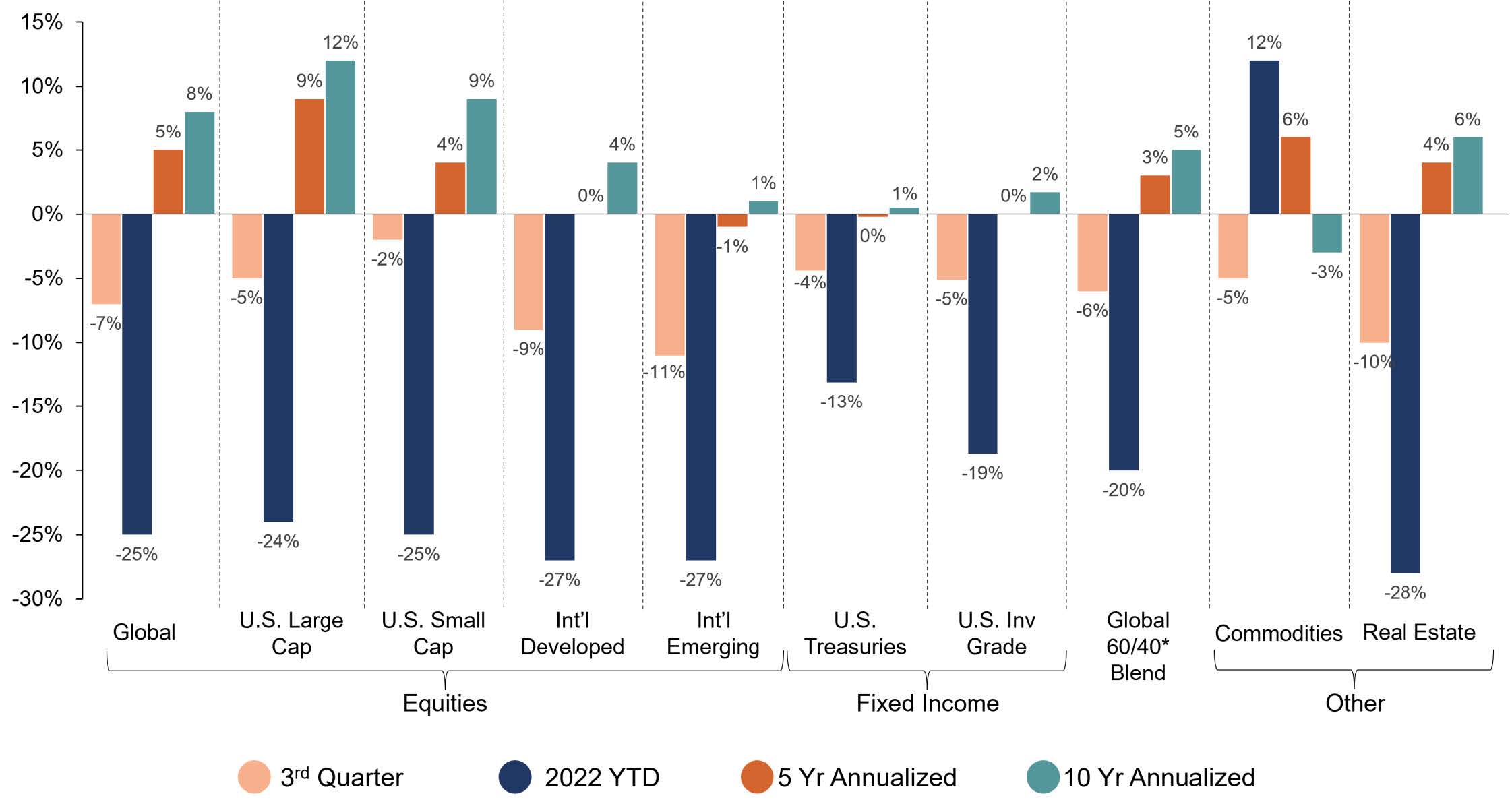

Significant volatility in the global financial markets was once again on display throughout the third quarter. Investors continue to grapple with the implications of high inflation and the attempts by policymakers to reign it in, as well as the prospect of weaker economic growth due to tighter monetary policy. Equity markets staged a brief rally this quarter through mid-August before suffering material declines in September, ultimately finishing the quarter near the low point of the year. Domestic markets once again performed better than international, with emerging market stocks suffering the most. Unfortunately, bonds offered little respite from the weakness in stocks as fixed income returns were negative for government, investment-grade, and high-yield corporate borrowers. The Bloomberg U.S. Aggregate Bond Index (a popular benchmark for the U.S. bond market) has declined -15% year to date, on pace for its worst year on record. Outside of traditional stocks and bonds, real estate returns continue to be weak, particularly disappointing for investors who expected the asset class to be a hedge against inflation. Commodities on the other hand have proven to be one of the few bright spots for the year. However, even commodities saw declines in the third quarter after prices peaked in the spring. Taken together, the traditional balanced portfolio of 60% in U.S. stocks and 40% in U.S. Treasury bonds is down over 20% in 2022. These kinds of returns are exceedingly rare for the 60/40 portfolio. In fact, since 1928 such a portfolio has seen double-digit declines only four times.

Performance for select asset classes as of 9/30/2022

Data Source: Bloomberg. Global equities are represented by the MSCI ACWI Index, U.S. Large Cap is represented by the S&P 500 TR Index, U.S. Small Cap is represented by the Russell 2000 TR Index, International Developed is represented by the MSCI EAFE TR Index, International Emerging is represented by the MSCI EM TR Index, U.S. Treasuries is represented by the Bloomberg U.S. Treasury TR Index, U.S. Investment Grade is represented by the Bloomberg U.S. Corporate TR Index, Global 60/40 is represented by 60% MSCI ACWI and 40% Bloomberg U.S. Treasury Index, Commodities is represented by the Bloomberg Commodity TR Index, and Real Estate is represented by the Dow Jones U.S. Real Estate TR Index.

Economic Outlook

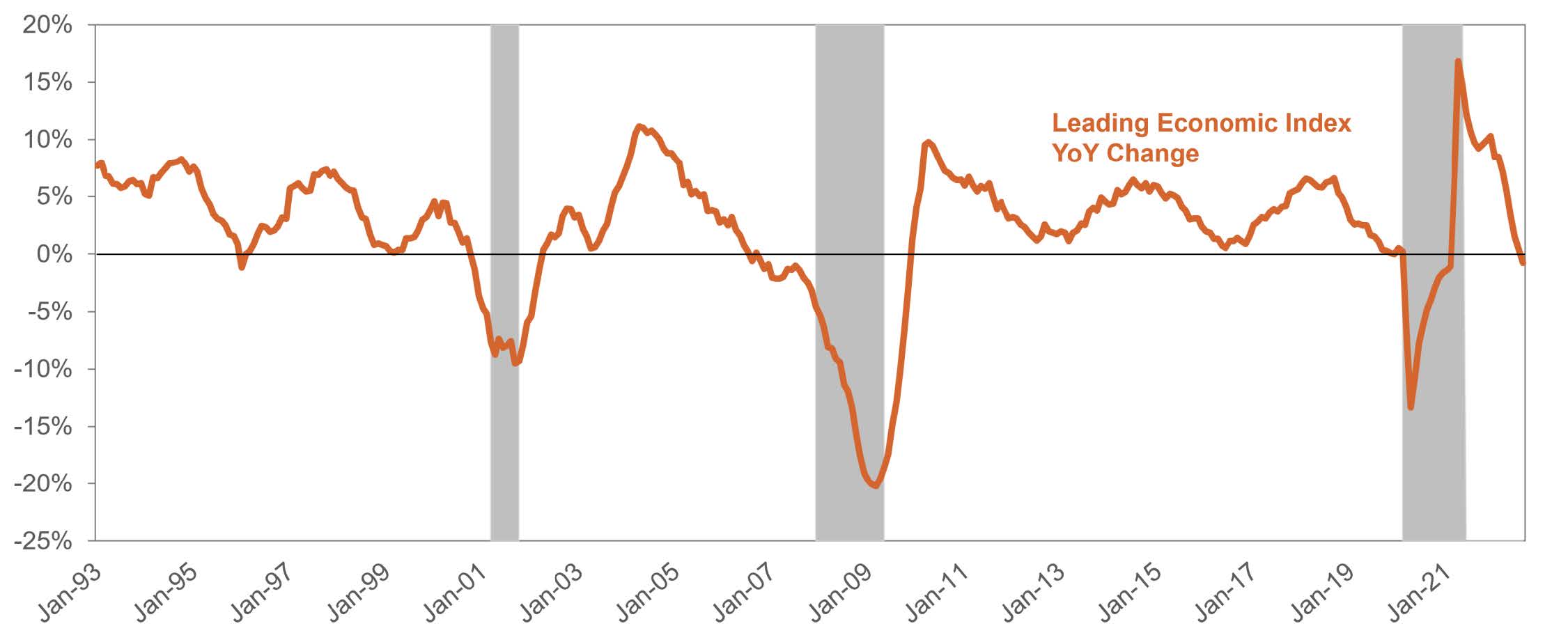

Looking ahead, we maintain a cautious posture despite the poor year-to-date results of the overall market that ordinarily auger well for forward returns. The U.S. Federal Reserve (Fed) has raised interest rate by more than three percentage points thus far this year in the hope that tighter financial conditions will slow the economy enough to curb inflation, but not so much to cause significant weakness in the labor market. The economy is in fact showing signs of slowing, with the housing market and manufacturing sector of the economy the most obvious signs. The Conference Board’s Leading Economic Index (an indicator intended to forecast future economic activity) has fallen for six consecutive months and is now down relative to a year ago. A decline of this nature is rarely seen outside of a recession. This downward trend supports a negative view of the health of the economy and the outlook for corporate profits. On the positive side, the labor market remains healthy, which should limit the magnitude of any weakness. Though we caution clients, labor statistics are generally lagging indicators and are one of the last economic signals to flash a warning.

Year over year change in the Conference Board LEI

Data Source: Bloomberg. Shaded areas indicate periods of U.S. economic recession.

Despite signs that growth is already slowing, the Fed has shown little indication it plans on reversing course. Historically, a combination of tighter financial conditions and a slowing economy is a bad recipe for risk assets. The picture outside our borders looks equally murky. Foreign central banks are struggling with similar inflationary pressures, the war in Ukraine continues to weigh on Europe, and a strong U.S. currency puts additional pressure on foreign economies. Separately, China faces persistent Covid challenges and stress in its property market.

Portfolio Positioning

As a result of the myriad of economic challenges, we have a cautious view on the outlook for corporate profit growth, the ultimate driver of stock prices, and have positioned portfolios somewhat more conservatively than we otherwise would. Despite challenging overall results, over the course of the third quarter and full year (as well as longer time frames) we see the positive impact of several decisions our team has made. For instance, we continue to invest our equity assets with a strong bias toward domestic markets. This has modestly contributed to performance this year but has been a significant contributor over longer time periods. As an example, the S&P 500 has outpaced the MSCI All Country World ex. U.S. Index by approximately 9% per year over the last ten years. Within fixed income allocations, we hold maturities shorter than average to reduce the risk rising interest rates pose to bond prices. While returns have still been negative year to date, our bond holdings have materially outperformed the Bloomberg U.S. Aggregate Bond Index, a commonly used measure of the broader U.S. bond market. Diversifying investments made to alternative asset classes have also helped overall portfolio returns this year as investments in Private Credit and trend-following managed futures funds have performed well.

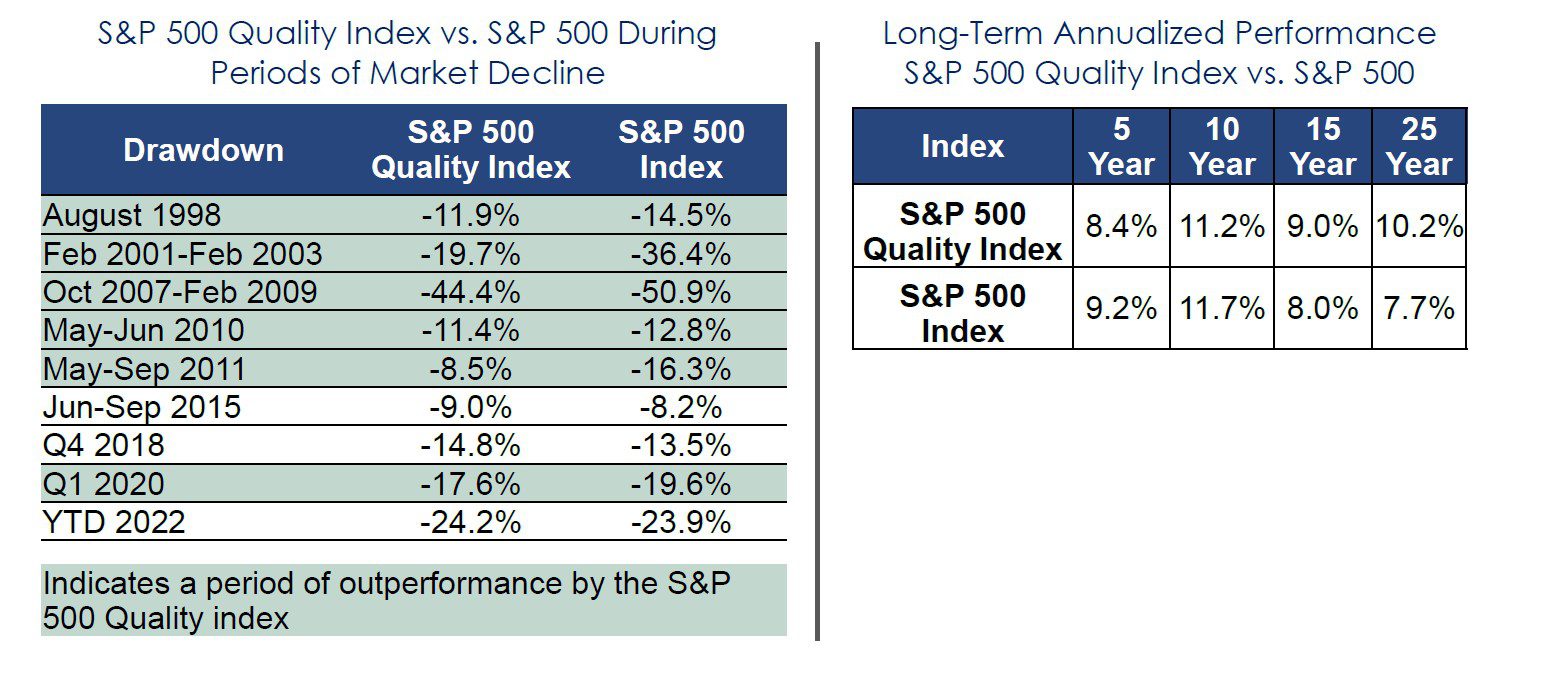

Conversely, our bias to invest in high-quality companies has weighed on performance this year, as evidenced by the S&P 500 Quality Index relative to the broader S&P 500 Index. Though BFM’s strategies differ from the S&P 500 Quality Index, the firm looks for investments with similar characteristics, and so the index serves as a helpful reference point.

The underperformance of quality runs counter to past experience, where quality indices have out-performed in down equity markets (see following table). Longer-term, a structural bias to higher quality companies has both added to total returns and reduced volatility. In addition, allocating portions of client portfolios to small and mid-sized companies have also weighed on current-year performance relative to larger cap indices. Our individual security selection has had a mixed record this year, with some in-house strategies outperforming their benchmarks, while others have lagged. Here too, the longer-term track records of our strategies remain competitive to strictly passive offerings.

Data Source: Bloomberg. Annualized returns. Both the S&P 500 and the S&P 500 Quality Index are unmanaged and do not reflect the deduction of advisor fees. Investors cannot invest directly in an index. Past performance is not indicative of future results.

Long-Term Positives

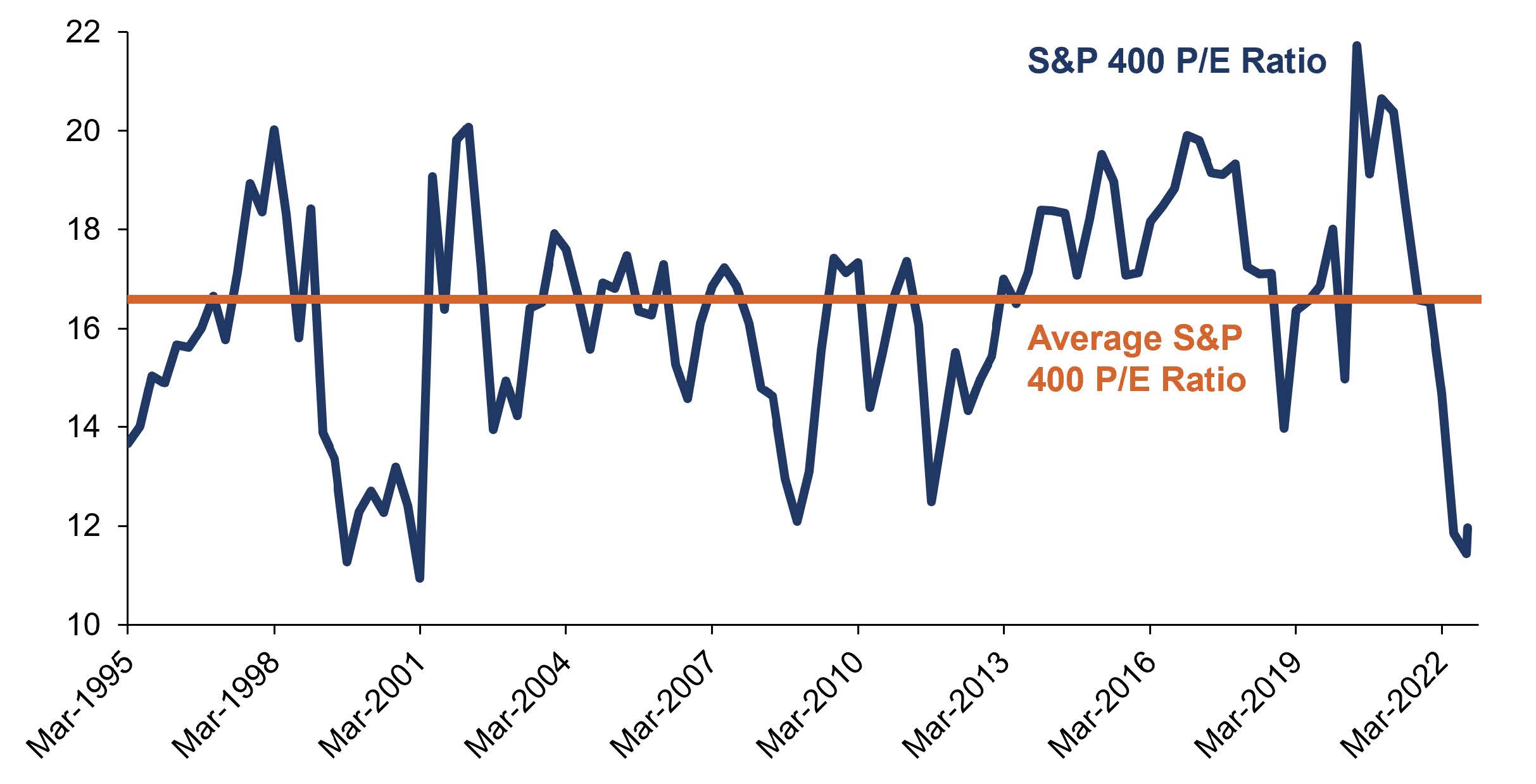

As we pointed out in our commentary at the end of September, financial market declines of the magnitude we have already experienced tend to lead to positive returns in the ensuing years. Abandoning one’s long-term investment plan can be tempting when times get tough, but it is often the worst time to do so. Looking across asset classes, bargains have begun to emerge for selective investors with appropriate time horizons. The benefit of asset class diversification, which was absent for much of the last decade, looks poised to provide a greater impact going forward. As an example, treasury bonds that mature in as little as six months (a suitable replacement for cash) are currently yielding over 4%. A diversified portfolio of investment-grade rated bonds is now priced to yield over 5%. This is well ahead of the low single-digit returns received from bonds over the last decade. Within equities, small and mid-cap stocks are trading at some of the lowest multiples of current expected earnings seen in the last twenty years (see following chart ). We are finding opportunities to take advantage of short-term volatility to take positions at attractive prices. Outside of stocks and bonds, strategies that take advantage of dislocations in commodity and credit markets are experiencing outsized returns this year with little sign that opportunity set has diminished.

S&P 400 Mid Cap Index Price to Earnings Ratio (P/E)

Data Source: Bloomberg. Average P/E ratio calculated from March 1995 through September 2022.

Closing Thoughts

We always remain careful not to whistle past the proverbial graveyard. We acknowledge there are near-term risks to the financial outlook. Often though, when things seem most dark, the opportunity is greatest. It is difficult to say when the economy and market will be free of these challenges, but if investors wait until the outlook is ‘all clear,’ it will likely be after a recovery in share prices. When it comes to the relationship between economic growth and the stock market, ‘better or worse’ matters more than ‘good or bad’ for stocks, and even minor improvements in the outlook can have important implications. Despite recent market volatility, we remain confident that client portfolios are well-positioned for longer-term success.

If you have questions about the capital markets, your individual portfolio, or how your assets are invested, please reach out to your Wealth Manager. We are always happy to take your calls and questions.

Brad M. Weafer, CFA

Chief Investment Officer

Market Commentary Disclaimer

This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.

Professional Designation Minimum Requirements Disclosure

CFA® – Chartered Financial Analyst. Minimum requirements for the CFA® designation include an undergraduate degree and four years of professional experience involving investment decision-making, in addition to successful completion of each of the three CFA level exams.