On October 20th, Boston Financial Management hosted a live webinar titled Preparing for an Evolving Tax Landscape. Please note that this webinar discusses the status of the recent tax proposals as of October 20, 2021. Since this date, President Biden has proposed a modified plan with fewer tax increases. However, Congress has continued to negotiate so it is still unclear which provisions will be in the final package. The House Rules Committee delayed a vote that was originally scheduled for Monday, November 1. We will continue to monitor any developments and send an alert with any significant updates.

The discussion was hosted by BFM’s Co-Chief Planning Officers, Alisa Kim O’Neil, JD, CTFA, AEP®, CDFA®, and Kathleen M. Sablone, JD, AEP®, as well as President and CEO, Louis P. Crosier.

The video is 45-minutes long, timestamps of the topics discussed are provided below. Feel free to jump to topics of interest or enjoy the presentation in its entirety!

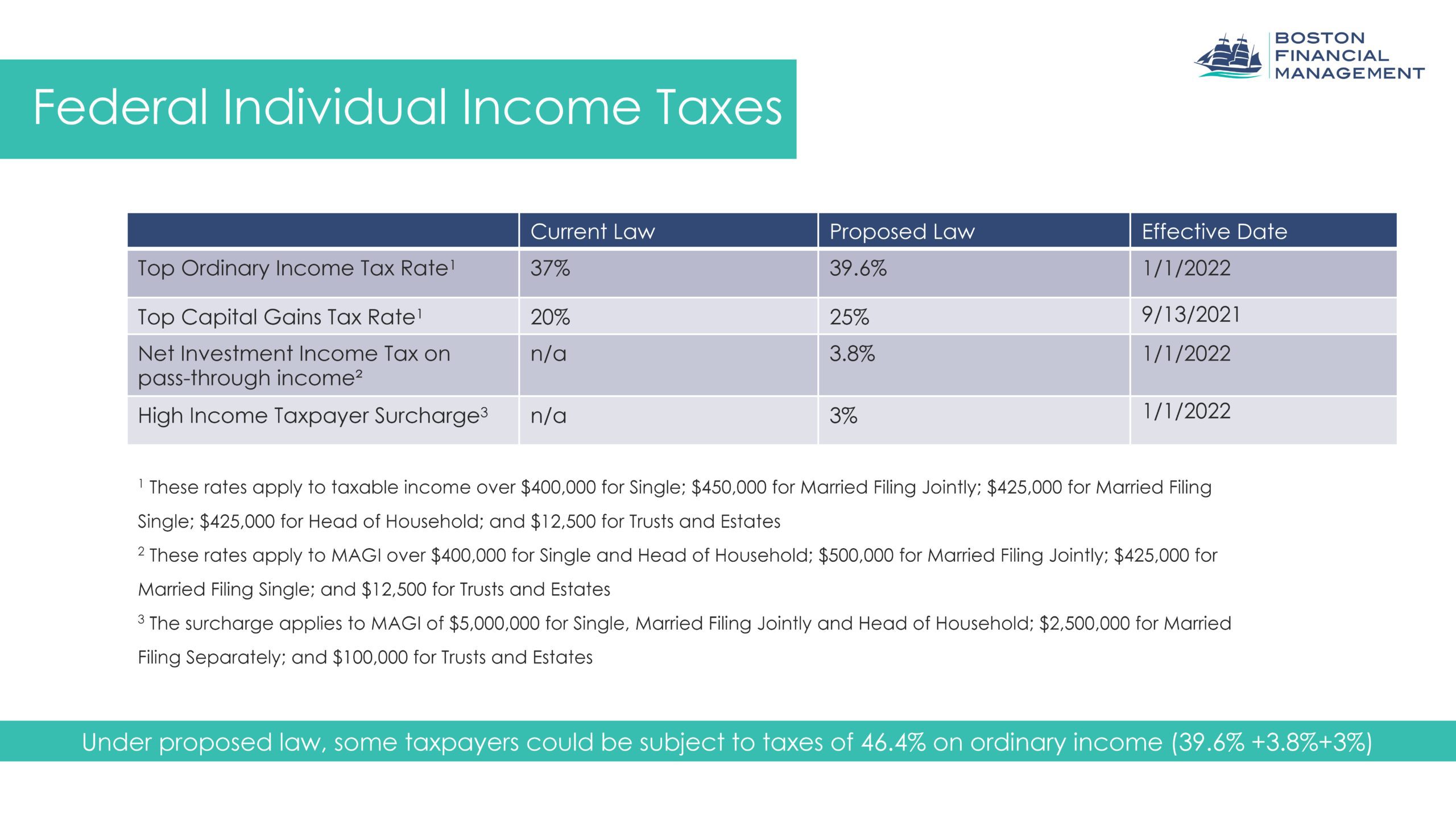

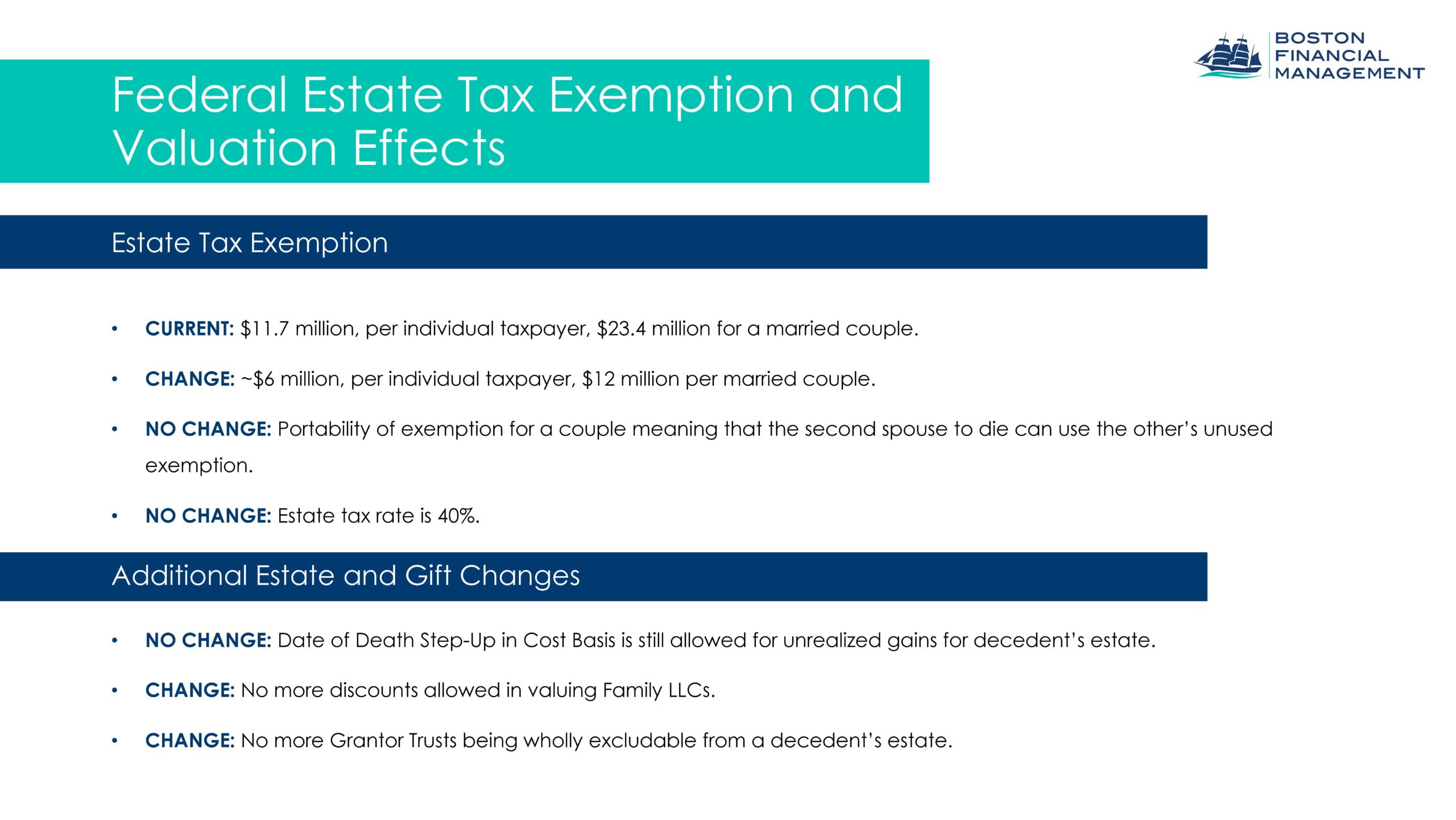

To help summarize the tax proposals discussed, please reference the below overview:

Professional Designation Minimum Requirements Disclosures

AEP® – Accredited Estate Planner®. Minimum requirements for the AEP® designation include active practice for a minimum of five years within the following disciplines: accounting; insurance and financial planning; law; philanthropy; and trust services with at least one-third of the individual’s time devoted to estate planning. Additionally, one or more of the following professional credentials: JD, CPA, CLU®, CFP®, CPWA®, CFA, CAP®, CSPG, CTFA, MSFS and MST is required, along with three professional references and current membership in an affiliated local estate planning council.

CDFA® – Certified Divorce Financial Analyst®. Minimum requirements for the CDFA® designation include a bachelor’s degree with three years of approved on-the job experience along with successful completion of the CDFA® examination consisting of 150 multiple choice questions. 30 hours of continuing education is required every two years.