by Brad M. Weafer, CFA Chief Investment Officer

by Brad M. Weafer, CFA Chief Investment Officer

To say life has been interrupted by the coronavirus crisis would be a gross understatement. The physical, social and financial toll the epidemic has had on everyday life is without precedent in modern American life. As stewards of capital however, it is our responsibility to invest through, and around, all the unprecedented situations life throws at us.

Times appear bleak. The country faces a health epidemic. The global economy has ground to a halt. The S&P 500 has fallen 25% from recent highs. Economic and virus data are almost certain to get worse first, not better. It’s no surprise then that one of the more frequent questions we have been hearing from clients is: “Shouldn’t we sell now since the market will obviously go lower?”. While the coronavirus is new, investor emotion and behavior are not. This question comes up often in trying times for the stock market. It is important to remember, stock prices already embed an expectation of the future. Case in point, on March 26 the number of Americans filing for unemployment benefits rose by 3.3 million in the previous week, four times the previous high set in the early 80s. In response, the Dow Jones Industrial Average capped its best 3-day streak since 1933, rising over 20% since Monday. If nothing else, this reinforces a valuable lesson, attempting to time each move of the market is an incredibly challenging endeavor, that typically costs investors over time.

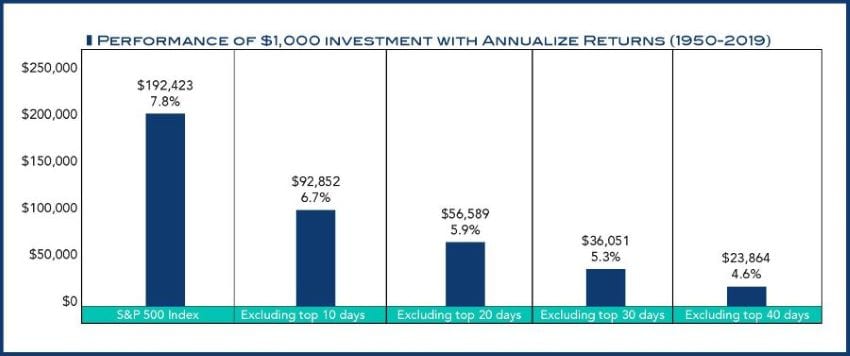

Aside from this anecdote, there is empirical evidence to support this difficult reality. The Schwab Center for Financial Research did a study dissecting returns for the S&P 500 since 1950 (see Figure 1 below). From 1950 through the end of 2019, the S&P 500 returned 7.8% annually. The study points out that missing only the 10 best days cost more than a full percentage point of annualized return! To put that into perspective, there were over 17,500 trading days during that time, 10 days is only a fraction of one hundredth of a percent. Missing the top 20 days had an even more egregious impact. This is extremely timely given Tuesday of last week was the third best single day advance for the S&P 500 since 1950 and there have only been 3 other days in the last two weeks that now qualify in the top 20. The Schwab study might have put it best, “time in the market is more valuable than timing the market”.

We find it even more interesting that the best days in the market typically occur in the scariest of times in the context of ongoing bear markets. Figure 2 below lists the best 20 return days for the S&P 500 from 1950 through 2019. Fifteen out of the top twenty days occurred during bear markets, another three occurred within weeks of an eventual bear market bottom. These great days happened when investor fear was highest, when it seemed “obvious” that the market would fall further. While difficult in real time, these are excellent lessons that we need to hold onto stocks when in the most frightening moments. Only in hindsight does this picture become clearer. When financial markets decline, many financial commentators (including me) will trot out the age old saying of “think long-term”. While recognizing at these times many clients and investors do not want to hear that, it remains the best advice for equity investors. Even in the depths of the last financial crisis and recession, after the S&P 500 fell over 50%, equity investors had achieved an 8% annual return for over the previous 20 years.

In no way however does this mean we should become complacent about future returns and protecting our investor’s capital. We remain vigilant about assessing future risk and return in the portfolios we manage. We invest in individual companies, from different industries, with very separate challenges and opportunities. We have redoubled our efforts to ensure that our companies and their balance sheets are sufficient to meet new and oncoming challenges. Where we see significant risk of capital impairment, we have exited positions as a result. Correlations across the market have spiked, stocks of poor companies and stocks of great companies have been indiscriminately sold together during the recent declines. This has created opportunities to increase position sizes in companies we have great conviction in and initiate new positions in companies that were previously too richly valued to provide an adequate future return. At the same time, we are paying close attention to the tax efficiency of portfolios, recognizing some losses where appropriate, but not indiscriminately selling all positions held at a current loss into short-term selling pressure. Our managers are actively helping clients assess their risk tolerance and cash needs following the swift decline in equity markets. These efforts help ensure we do not make errors of emotion and sell risk assets only after recognizing declines. We will continue to adjust portfolios to balance the risk of the coronavirus amid future risks as diligently as possible.The team at Boston Financial Management is always available to answer your questions. Please do not hesitate to contact your Wealth Manager directly, or call our main line at 617-338-8108.

Market Commentary Disclaimer: This publication is for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. The information contained herein is the opinion of Boston Financial Management and is subject to change at any time based upon unforeseen events or market conditions.